New York State 529 Plan

New York State single filers can deduct up to 5000 in annual contributions when calculating their New York state income tax. New York also has a 529 Able Plan as well.

Best 529 Plans For 2021 Reviews Ratings And Rankings White Coat Investor

Best 529 Plans For 2021 Reviews Ratings And Rankings White Coat Investor

New York state has taken a different approach from the Federal government and determined that withdrawals from your NY 529 plan will NOT be considered qualified withdrawals for New York state taxes when used on K-12 expenses.

New york state 529 plan. New Yorks 529 Advisor-Guided College Savings Program is a college savings plan sponsored by the State of New York that provides a tax-advantaged way for families to save for the future costs of higher education. Please consult your tax advisor. New Yorks 529 College Savings Program is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses.

529 plans offer tax-advantaged ways to save money because investments made in these accounts grow tax-free and all withdrawals used for qualified higher education expenses are exempt from federal income tax. New York has a 529 plan called New Yorks 529 College Savings Program NY529 that can help you save for college. The state income tax deduction is only available to the account owner or their spouse.

For overnight delivery or registered mail send to. Direct this 529 plan can be purchased directly through the state. Box 55440 Boston MA 02205-8323.

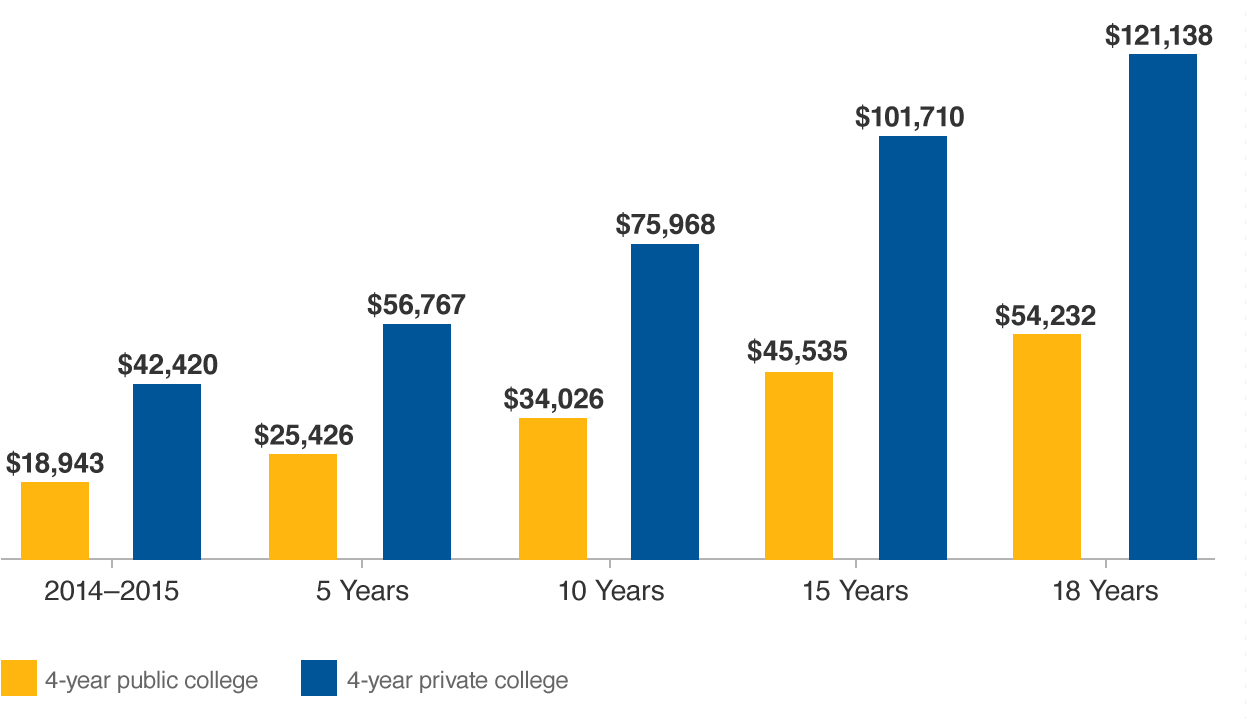

New York offers residents an annual state income tax deduction for contributions of up to 5000 10000 if married filing jointly to a New York 529 plan. New York 529 plan state income tax deduction. New York College Costs Trends.

What That Means for You. 63 rows A 529 plan is a state-sponsored savings plan that allows parents to invest funds that you or. Ad Book your Hotel in New York NY online.

New Yorks 529 College Savings Program offers some decent tax protections. This state offers an in-state tax benefit for contributing to a 529 plan. 529 College Savings Program Direct Plan PO.

If youre not a New York State taxpayer before investing consider whether your or your beneficiarys home state offers a 529 plan that provides its taxpayers with favorable state tax or other benefits that may only be available through investment in the home states 529 plan and which arent available through investment in the Direct Plan. It is important to note that your child does not have to go to a NY college or university in order to use this savings account. 1 Earnings on nonqualified withdrawals may be subject to federal income tax and a 10 federal penalty tax as well as state and local income tax.

New York State taxpayers can deduct up to 5000 10000 for a married couple filing jointly of contributions to their New York Direct Plan account from their state taxable income each year. See the plans below to take advantage of the tax deduction available to New York residents. Learn who administers the NYSAVES Direct Plan and Advisor Plan.

These programs are designed to help make college more affordable - so that you can get the education you need. Married couples filing jointly can deduct up to 10000 in contributions. 529 plan funds can be used at any accredited college or university across the nation including some K-12 private schools.

Tax Benefits of New Yorks 529 Plan. Ad Book your Hotel in New York NY online. What are the tax advantages to a 529 plan.

If you live in New York these might be good options for you to save for college. New Yorks 529 College Savings Program Direct Plan 95 Wells Avenue Suite 155 Newton MA 02459-3204. If you withdraw money from your NY 529 plan for K-12 expenses youll have to.

New York has its own state-operated 529 plan called New Yorks 529 College Savings Program. For overnight delivery or registered mail send to. If you live in New York and are planning to put a child through college you can receive a substantial tax deduction by contributing to New Yorks 529 College Savings Program.

Visit NYs 529 College Savings Plan website to learn more.

State 529 College Savings Plans Are Cutting Fees New Analysis Finds The New York Times

State 529 College Savings Plans Are Cutting Fees New Analysis Finds The New York Times

How Much Is Your State S 529 Plan Tax Deduction Really Worth

How Much Is Your State S 529 Plan Tax Deduction Really Worth

Ny S 529 College Savings Program Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2020 My Money Blog

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2020 My Money Blog

Rating The Top 529 College Savings Plans Morningstar

Rating The Top 529 College Savings Plans Morningstar

Cost Of College Ny 529 Direct Plan

Cost Of College Ny 529 Direct Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2019 Kap Kksp Partners

The Top 529 College Savings Plans Of 2020 Morningstar

The Top 529 College Savings Plans Of 2020 Morningstar

Ny 529 Direct Plan On Twitter If You Just Moved To New York State We Can Help You Move Your Child S 529 Savings To Our Low Fee High Convenience Plan Https T Co Cum6bmg1ls Https T Co Bj9naew34h

Ny 529 Direct Plan On Twitter If You Just Moved To New York State We Can Help You Move Your Child S 529 Savings To Our Low Fee High Convenience Plan Https T Co Cum6bmg1ls Https T Co Bj9naew34h

New York Ny 529 College Savings Plans Saving For College

New York Ny 529 College Savings Plans Saving For College

Avoid The Top 529 Plan Mistakes Ny 529 Direct Plan

Avoid The Top 529 Plan Mistakes Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

New York 529 Plan And College Savings Options Ny529

New York 529 Plan And College Savings Options Ny529

Comments

Post a Comment