Form 8849 Schedule 6

If you attach additional sheets write your name and taxpayer identification number on each sheet. Complete for lines 1a 2a 4a 4b 5a and 5b.

Https Www Irs Gov Pub Irs Prior F8849 2009 Pdf

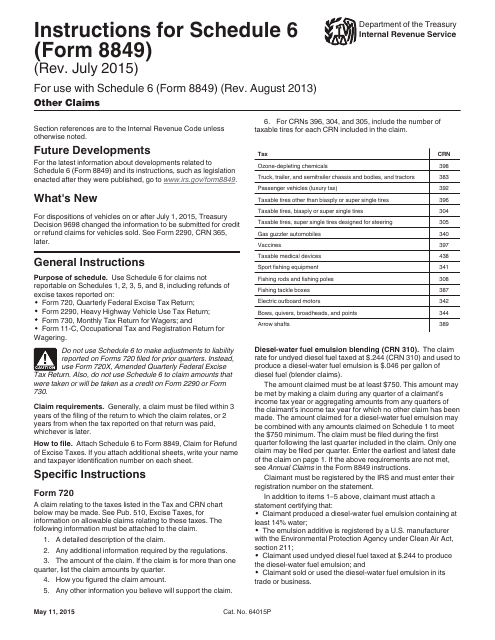

The Form 8849 Schedule 6 is used for claims which arent reported on Schedules 1235 and includes the refunds of excise taxes reported on.

Form 8849 schedule 6. Updated on June 17 2020 - 1030 AM by Admin ExpressTruckTax. Use this schedule for claims not reportable on Schedules 1 2 3 5 and 8 including refunds of excise taxes. Total refund see instructions Caution.

You can also use Schedule 6. What is Schedule 6 Form 8849. Name as shown on Form 8849.

Information about Schedule 6 Form 8849 Other Claims including recent updates related forms and instructions on how to file. To claim amounts that you took or will take as a credit on Schedule C Form 720 Form 730 Form 2290 or Form 4136. Auto-Generate Form 8849 Schedule 6 with ExpressTruckTax.

Also complete for lines 3d and 3e type of use 14. Form 720 Quarterly Federal Excise Tax Return. There is no deadline to file this return.

Any refund for the vehicles that was either sold destroyed or stolen used less than the mileage use limit or tax overpaid can be claimed using Form 8849 with duly filled return. Instead use Form 720X Amended Quarterly Federal Excise Tax Return. The refund amount will depend on when the vehicle was sold destroyed or stolen.

Use Schedule 6 for claims not reportable on Schedules 1 2 3 5 and 8 including refunds of excise taxes reported on. Alternatively a refund of the tax paid can be claimed on Form 8849 Schedule 6 Other Claims. To Claimants registration no.

You can file Form 8849 Schedule 6 to claim a 2290 tax credit if the vehicle you filed for was sold destroyed stolen or did not exceed mileage credit. May 2020 Nontaxable Use of Fuels Department of the Treasury Internal Revenue Service Attach to Form 8849. IRS Form 8849 is filed to claim excise taxes refund or particular fuel related refunds like nontaxable sales of fuels.

Form 8849 lists the schedules by number and title. Schedule 6 Form 8849 and its instructions such as legislation enacted after they were published go to wwwirsgovform8849. Any refund for the vehicles that was either sold destroyed or stolen used less than the mileage use limit or tax overpaid can be claimed using Form 8849 with duly filled return.

Complete for lines 1b and 2c. Information about Schedule 6 Form 8849 Other Claims including recent updates related forms and instructions on how to file. See Form 2290 CRN 365 later.

Schedule 6 is used for claims not reportable on Schedules 1 2 3 5 and 8 including refunds of excise taxes reported on. Name as shown on Form 8849. UV claimant must complete line 6 or 7 on page 3.

Form 8849 schedule 6. Use this schedule for claims not reportable on Schedules 1 2 3 5 and 8 including refunds of excise taxes. Form 8849 schedule 6.

Schedule 1 Form 8849 Rev. Total refund see instructions Period of claim. Any refund for the vehicles that was either sold destroyed or stolen used less than the mileage use limit or tax overpaid can be claimed using Form 8849.

Form 8849 Schedule 6 is an IRS form used to claim a refund of excise taxes. Do not use Form 8849 to make adjustments to liability reported on Forms 720 for prior quarters or to claim any amounts that were or will be claimed on Schedule C Form 720 Claims Form 4136 Credit for Federal Tax Paid on Fuels Form. Attach Schedule 6 to Form 8849 Claim for Refund of Excise Taxes.

Dont file with any other schedule. IRS Form 8849 Schedule 6 allows truckers to claim their excise tax refund for vehicles that were sold destroyed stolen or claim credit for low mileage vehicles. Use Form 8849 refunds of excise taxes reported on Form 2290.

Schedule 1 Schedule 2 Schedule 3 Schedule 5 Schedule 6 Caution. Whats New For dispositions of vehicles on or after July 1 2015 Treasury Decision 9698 changed the information to be submitted for credit or refund claims for vehicles sold. Form 720 Quarterly.

Schedule 6 is used for claims not reportable on Schedules 1 2 3 5 and 8 including refunds of excise taxes reported on. When you are filing Form 2290 with ExpressTruckTax and if your tax credits are higher than the HVUT for the current tax. For the latest information.

The IRS Form 8849 Schedule 6 helps you claim tax refund for vehicles that were sold destroyed or stolen. If you already paid the tax on a vehicle you used for less then 5000 miles you can claim a credit on the first Form 2290 you file for the next tax period. Enter month day and year in MMDDYYYY format.

Fillable Online Irs For Use With Schedule 6 Form 8849 Rev Irs Fax Email Print Pdffiller

Fillable Online Irs For Use With Schedule 6 Form 8849 Rev Irs Fax Email Print Pdffiller

Https Www Irs Gov Pub Irs Access F8849s6 Accessible Pdf

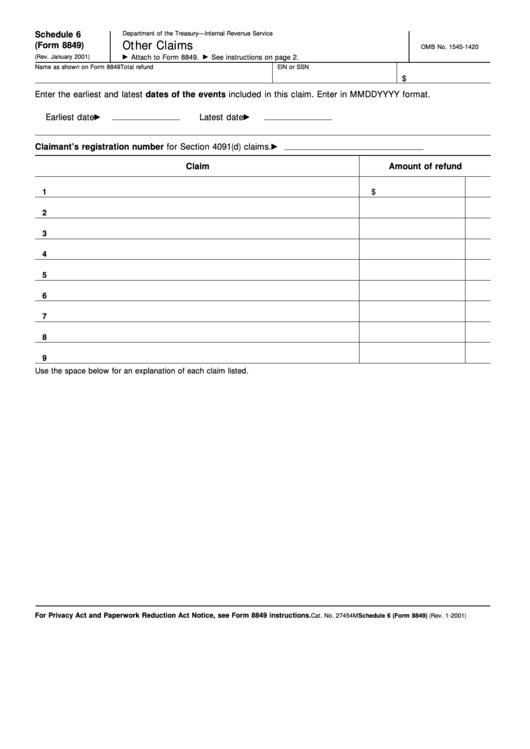

Fillable Online Form 8849 Schedule 6 Rev January 2001 Other Claims Fax Email Print Pdffiller

Fillable Online Form 8849 Schedule 6 Rev January 2001 Other Claims Fax Email Print Pdffiller

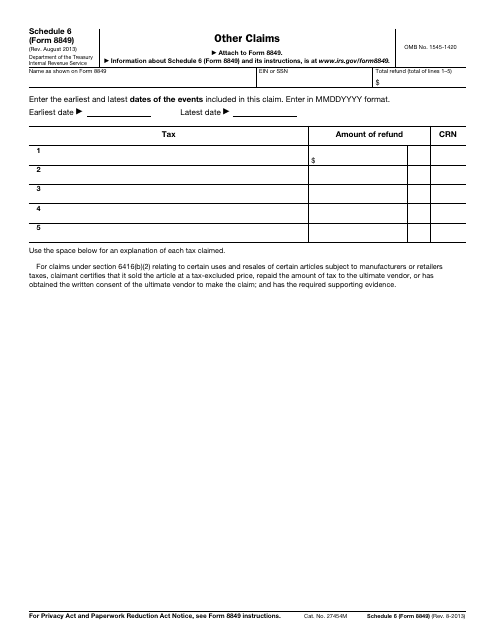

Fillable Online Irs Schedule 6 Form 8849 Rev August 2013 Other Claims Irs Fax Email Print Pdffiller

Fillable Online Irs Schedule 6 Form 8849 Rev August 2013 Other Claims Irs Fax Email Print Pdffiller

Https Www Irs Gov Pub Irs Pdf F8849 Pdf

Https Www Irs Gov Pub Irs Prior F8849s6 2008 Pdf

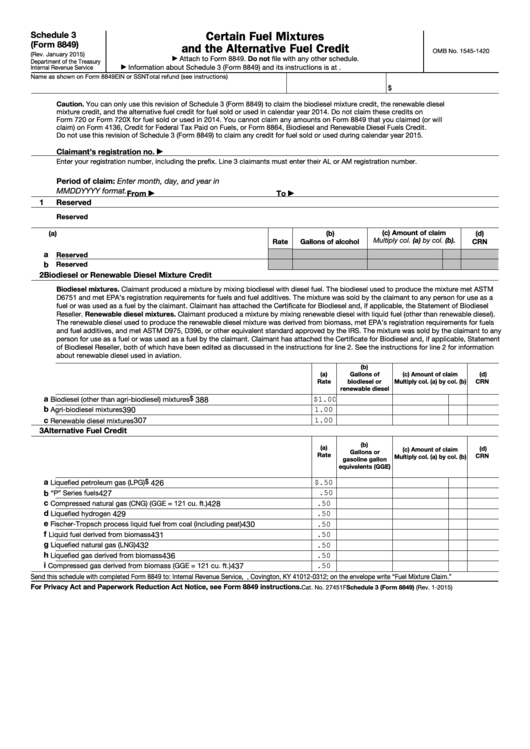

Top 6 Form 8849 Schedule 3 Templates Free To Download In Pdf Format

Top 6 Form 8849 Schedule 3 Templates Free To Download In Pdf Format

Irs Form 8849 Schedule 6 Download Fillable Pdf Or Fill Online Other Claims Templateroller

Irs Form 8849 Schedule 6 Download Fillable Pdf Or Fill Online Other Claims Templateroller

Https Www Irs Gov Pub Irs Prior F8849s6 2005 Pdf

Fillable Schedule 6 Form 8849 Other Claims Printable Pdf Download

Fillable Schedule 6 Form 8849 Other Claims Printable Pdf Download

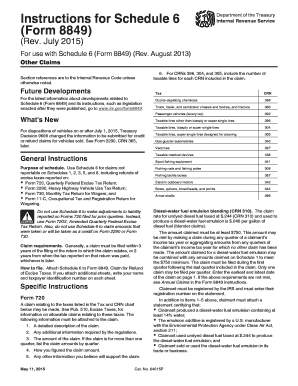

Download Instructions For Irs Form 8849 Schedule 6 Other Claims Pdf Templateroller

Download Instructions For Irs Form 8849 Schedule 6 Other Claims Pdf Templateroller

Irs Form 8849 Form 8849 Claim Refund Express 8849

Irs Form 8849 Form 8849 Claim Refund Express 8849

Irs Form 8849 Form 8849 Schedule 6 Claim For Refund

Irs Form 8849 Form 8849 Schedule 6 Claim For Refund

Comments

Post a Comment