How To Get Work History From Irs

Under most circumstances there is a charge involved for detailed earnings information. Click Forms and Publications on the left hand navigation sidebar.

4 Ways To Get Your Employment History Wikihow

4 Ways To Get Your Employment History Wikihow

Get Award Winning Legal Guidance Today.

How to get work history from irs. Transcripts are free and arrive within five to. To order transcripts of tax returns print and complete IRS Form 4506 and mail it to the IRS at the address provided on the form along with the required payment of 50 for each return required. How to get your employment history Fill in the application form and send it to HMRC.

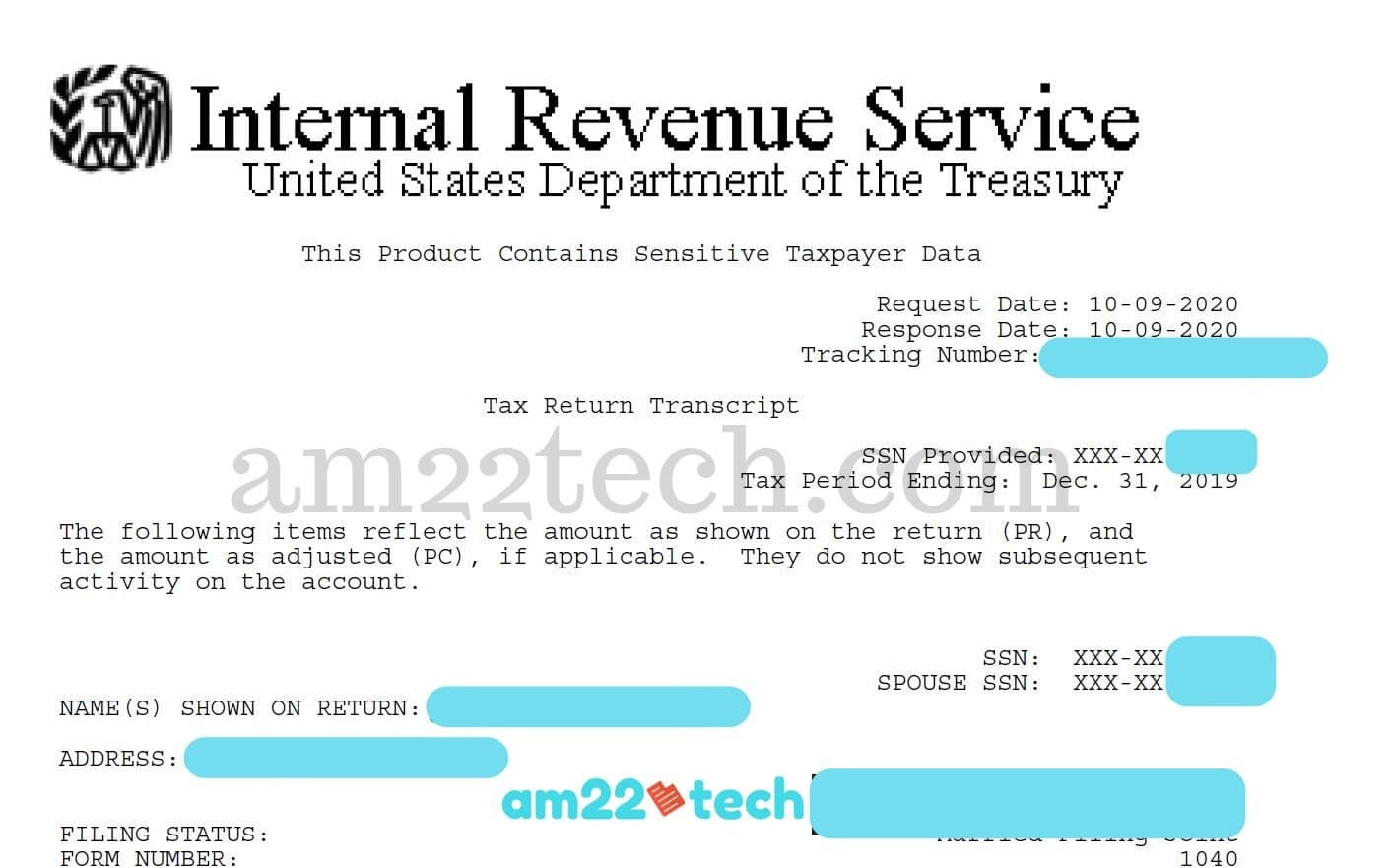

How To Get Work History From Irs. To register and use this service you need. A tax return transcript includes information from your originally filed tax return.

Youll receive detailed information about your work history including employment dates employer names and addresses and earnings. Obtaining Employment History from the Internal Revenue Service Visit the Internal Revenue Services website at wwwIRSgov. If you or the IRS amended your return that information is found on the tax account transcript.

You can find your employment history through your Social Security records IRS filings and credit reports. The Social Security Administration will provide copies of Forms W-2 for retirement purposes at no charge and for other than retirement purposes for a fee of 3700. Answer --- To obtain a detailed statement of your employment history you need to complete Form SSA-7050-F4 Request For Social Security Earnings Information.

WalletHub even alerts you when a new employer has been added to your report. Employment verification letter publication 505 2020 tax withholding irs tax transcripts w 4 tax form 4 ways to get your employment history. The first two options usually come with fees but you can check your credit report for free by joining WalletHub.

If youre applying through a solicitor or tax agent youll first need to give them. The Internal Revenue Service IRS provides tax transcripts if you need to lay your hands on an old return that you lost or didnt save. Get Award Winning Legal Guidance Today.

Top London divorce lawyers with a formidable reputation in complex and high value divorces. You can also request tax transcripts by calling 800-908-9946 and following the prompts. The IRS work and income transcript is free.

You can receive a statement of your employment history from the Social Security Administration SSA by completing a Request for Social Security Earnings Information form. The only way to get a copy of your Form W-2 from IRS is to order a copy of the entire return on Form 4506 PDF Request for Copy of Tax Return and pay a fee of 3900 per tax year. If your earnings are below the minimum needed to earn all four work credits per year youd need to work.

When You Need a. Keep reading to learn more about the documents the IRS can provide you with and how to get them. Ad Talk To The Best Lawyers About Your Divorce Case.

Form w 9 definition 4 ways to get your employment history wikihow 4 ways to get your employment history wikihow still no stimulus check what the irs wants you to know before. The IRS is also glad to provide you with other forms and information about your tax history free of charge. Top London divorce lawyers with a formidable reputation in complex and high value divorces.

Whether you work as a full- or part-time employee your employer has to provide you with a Form W-2 at the end of each tax year. On irs form 1040 i accidentally 2016 2020 form irs 4180 fill 4 ways to get your employment history 4 ways to get your employment history. Ad Talk To The Best Lawyers About Your Divorce Case.

Your SSN date of birth filing status and mailing address from latest tax return access to your email account your personal account number from a credit card mortgage home equity loan home equity line of credit or car loan and. You can get your income and job history by ordering a transcript from either the Internal Revenue Service or the Social Security Administration. Requests for copies of transcripts may take 45 days after they are received to be completed and mailed.

The address is on the form. If you have a work history that is. You can order it online via the IRS Get Transcript Online portal or via mail or fax by completing IRS Form 4506-T.

Search for IRS Form 4506. That means you must work at least 10 years to qualify based on your work history. Past employment dates dating back 10 years are available from the IRS by requesting a copy of your tax return and attached documents.

This form includes all income you earned with that employer as well as how much was withheld for taxes. The 4506 series is used to request a transcript or copy of past income tax returns. Another option to obtain your full employment history is to request your IRS records.

4 Ways To Get Your Employment History Wikihow

4 Ways To Get Your Employment History Wikihow

How To Get Irs Tax Transcript Online For I 485 Filing Usa

How To Get Irs Tax Transcript Online For I 485 Filing Usa

3 Ways To Get Copies Of Old W 2 Forms Wikihow

3 Ways To Get Copies Of Old W 2 Forms Wikihow

4 Ways To Get Your Employment History Wikihow

4 Ways To Get Your Employment History Wikihow

How To Get Your Old Irs Forms W 2 And 1099 By Getting Irs Transcripts H R Block

How To Get Your Old Irs Forms W 2 And 1099 By Getting Irs Transcripts H R Block

Locating My Personal Employment History Lovetoknow

Locating My Personal Employment History Lovetoknow

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

/application-form-171554453-262c63734ece439580be13d33a8da423.jpg) How To Find Your Employment History

How To Find Your Employment History

![]() 4 Ways To Get Your Employment History Wikihow

4 Ways To Get Your Employment History Wikihow

Get Transcript Internal Revenue Service

How To Obtain Work History From Irs The Best Picture History

How To Obtain Work History From Irs The Best Picture History

How To Obtain An Employment Or Wage History Report From The Irs

How To Obtain An Employment Or Wage History Report From The Irs

4 Ways To Get Your Employment History Wikihow

4 Ways To Get Your Employment History Wikihow

How To Request Employment History From The Irs

Comments

Post a Comment