How To Withdraw Money From 401k

Most People Dont Know That The State Could Be Holding Unclaimed Money In Their Name. Ad US retirement funds withdrawal can be tax-free in the US for Non Resident Alien 401k IRA.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

1 Depending on your.

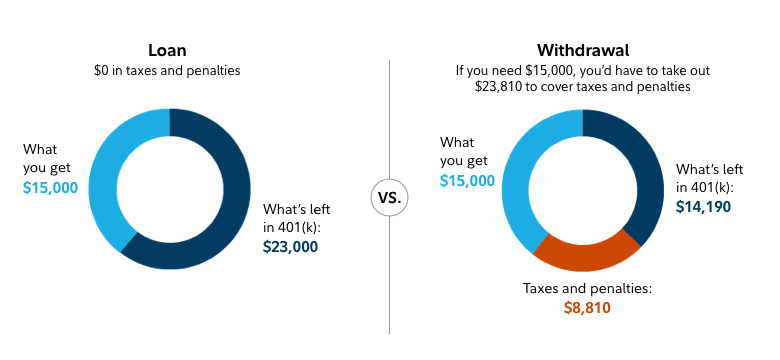

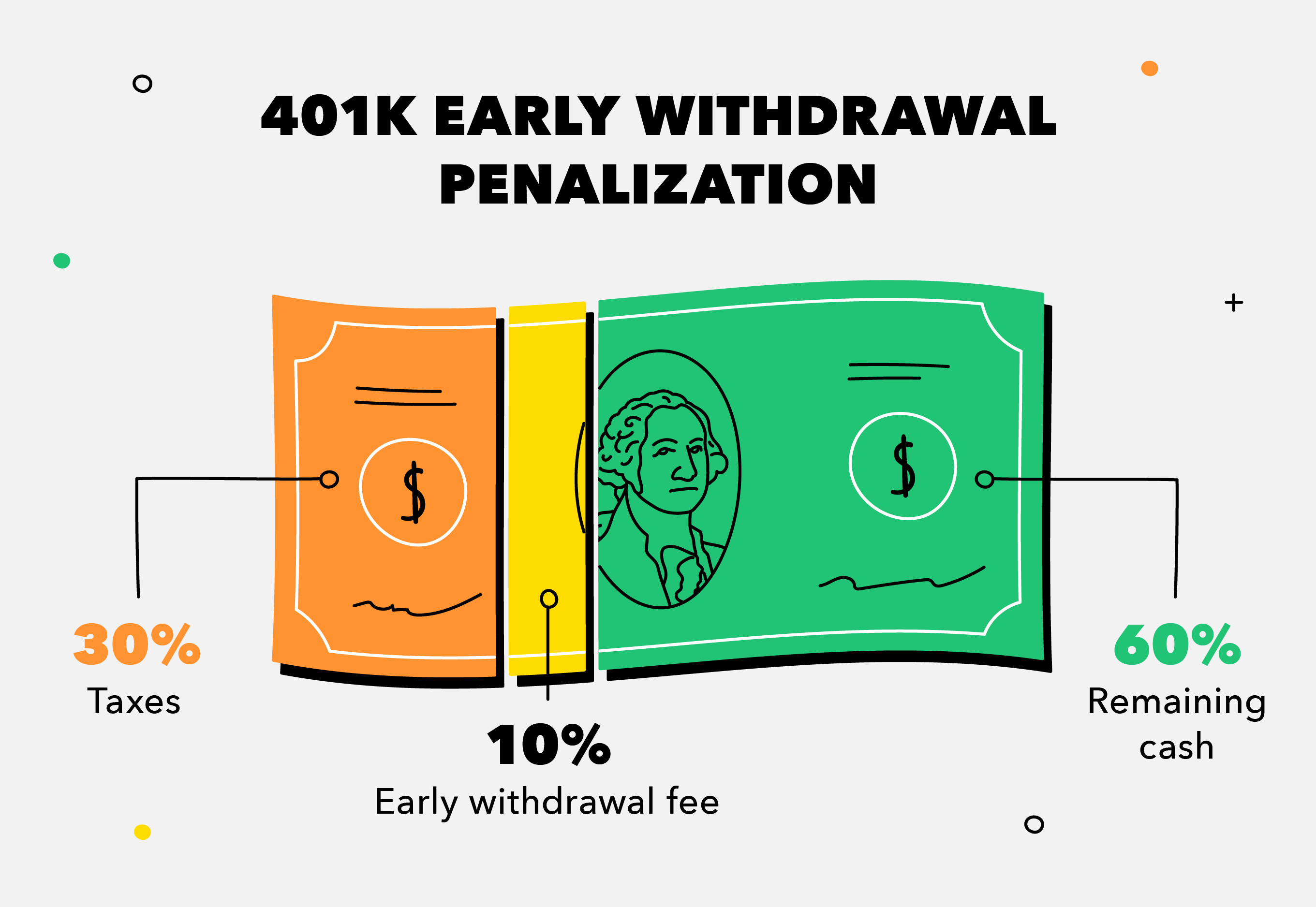

How to withdraw money from 401k. A loan is often the only way you can access the money in a 401k if youre still employed by that company. The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. If you retire after age 59½ the Internal Revenue Service IRS allows you to begin taking distributions from your 401 k without owing a 10 early withdrawal penalty.

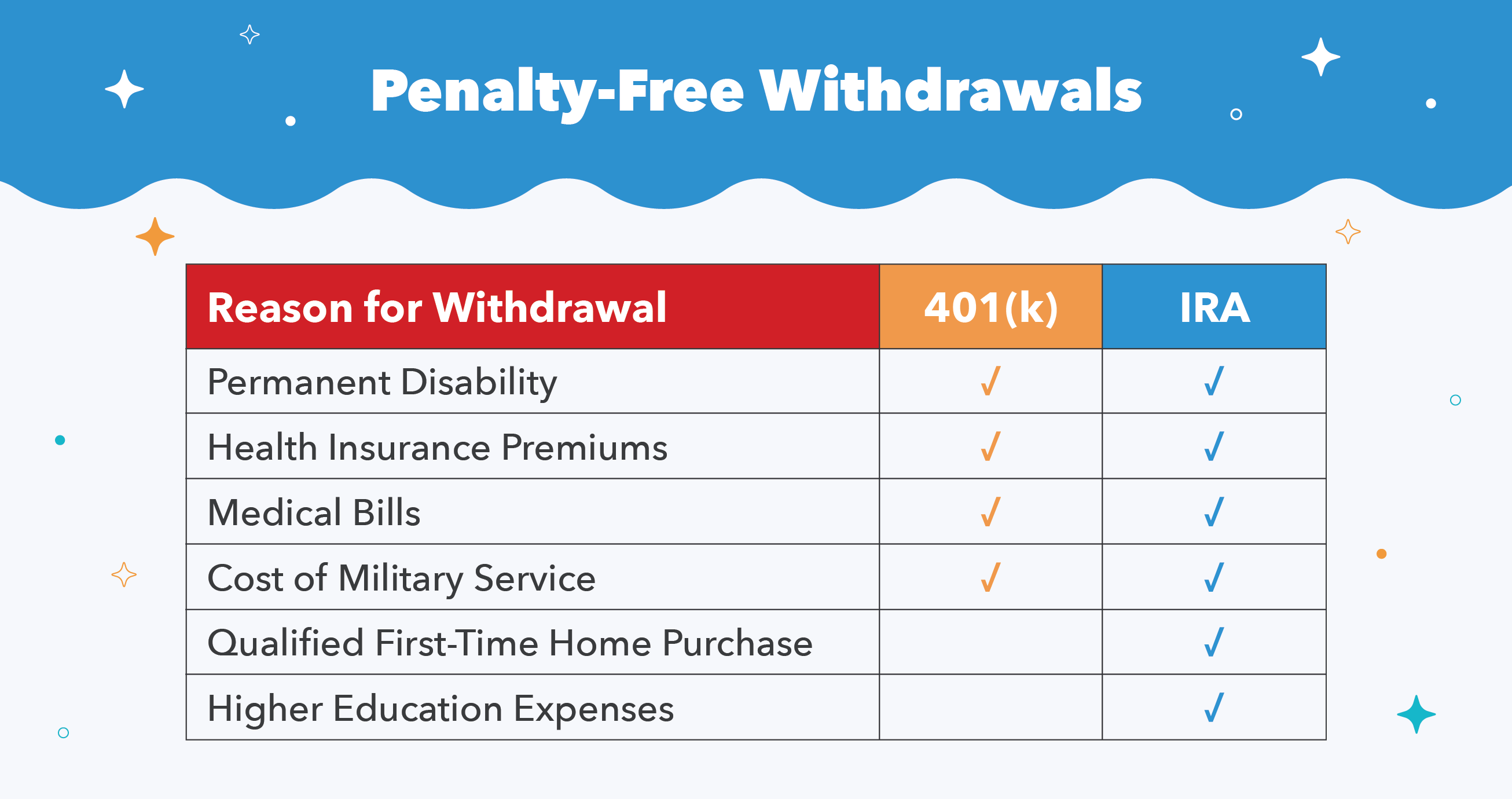

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. Withdrawing from a 401 k The first and least advantageous way is to simply withdraw the money outright. Following the March 2020 passage of the COVID-19 focused CARES ACT it is possible to withdraw up to.

Most People Dont Know That The State Could Be Holding Unclaimed Money In Their Name. RMD rules mandate you withdraw a certain portion of your investment account balance each year after you reach age 72. Call us learn more.

Ad US retirement funds withdrawal can be tax-free in the US for Non Resident Alien 401k IRA. A loan lets you borrow money from your retirement savings and pay it back to yourself over time with interestthe loan payments and interest go back into your account. You can withdraw your entire US 401k IRA Tax Free using Tax Treaty.

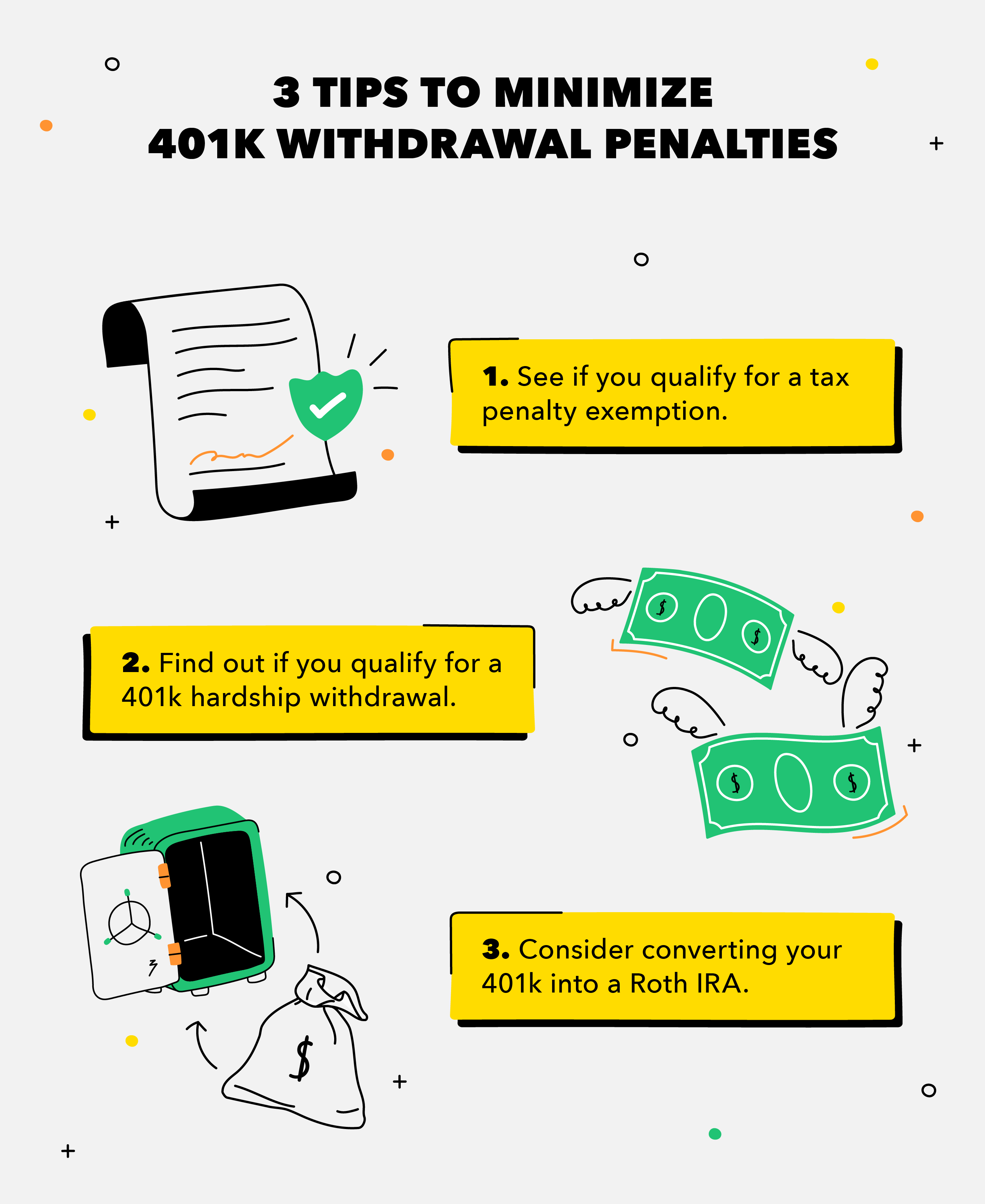

You can do a rollover of your 401k account balance to an IRA at a company of your choice. You can start withdrawing funds from a 401 k or IRA without penalty after age 595 but you dont have to start taking required minimum distributions RMDs from tax-deferred retirement accounts until age 72 705 if you reached age 705 before Jan. Exactly how much youll need to withdraw depends largely on your 401 k balance and its calculated by the IRS.

A Roth IRA works differently. By age 59½ and in some cases age 55 you will be eligible to begin withdrawing money from your 401k without having to pay a penalty tax. Ad We Can Help You Find Unclaimed Money In Your Name.

If you dont youre subject to a 50 tax penalty on the amount you failed to. You only pay taxes on the amount you withdraw each year. Dont Wait - Try Searching Today.

This comes under the rules for hardship withdrawals which. The article at this link explains the differences between a 401k loan and a 401k withdrawal. It must be the amount necessary to satisfy the financial need That sum can however include whats required to pay taxes and penalties on the.

You cant just withdraw as much as you want. You can withdraw up to 5000 tax-free to cover costs associated with a birth or adoption. This is a very tricky calculation since you dont know what youll earn in any given year nor what the rate of.

If you dont take your RMD on time youll be hit with a hefty tax penalty --. Not an easy task. Call us learn more.

Dont Wait - Try Searching Today. Ad We Can Help You Find Unclaimed Money In Your Name. You pay no taxes if you do a rollover to an IRA and your money can stay in your IRA for your later use.

Then you can withdraw amounts from your IRA only as you need it. Your tax liability is based on the total of all your income including your 401 k plan withdrawals interest and dividends and any wages you may have. Loans and withdrawals from workplace savings plans such as 401 ks or 403 bs are different ways to take money out of your plan.

When you do your tax return the money you pulled from your 401 k during the previous year is simply added to your other income. You can withdraw your entire US 401k IRA Tax Free using Tax Treaty.

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png) Can I Withdraw Money From My 401 K Before I Retire

Can I Withdraw Money From My 401 K Before I Retire

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

How To Make A 401 K Hardship Withdrawal

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png) 401 K Hardship Withdrawals Here S How They Work

401 K Hardship Withdrawals Here S How They Work

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

How To Withdraw From Your 401 K Plan In Retirement Kiplinger

How To Withdraw From Your 401 K Plan In Retirement Kiplinger

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

401 K Early Withdrawal Vs 401 K Loan Which Is Better Cnn Underscored

401 K Early Withdrawal Vs 401 K Loan Which Is Better Cnn Underscored

Comments

Post a Comment