Trump Tax Rates

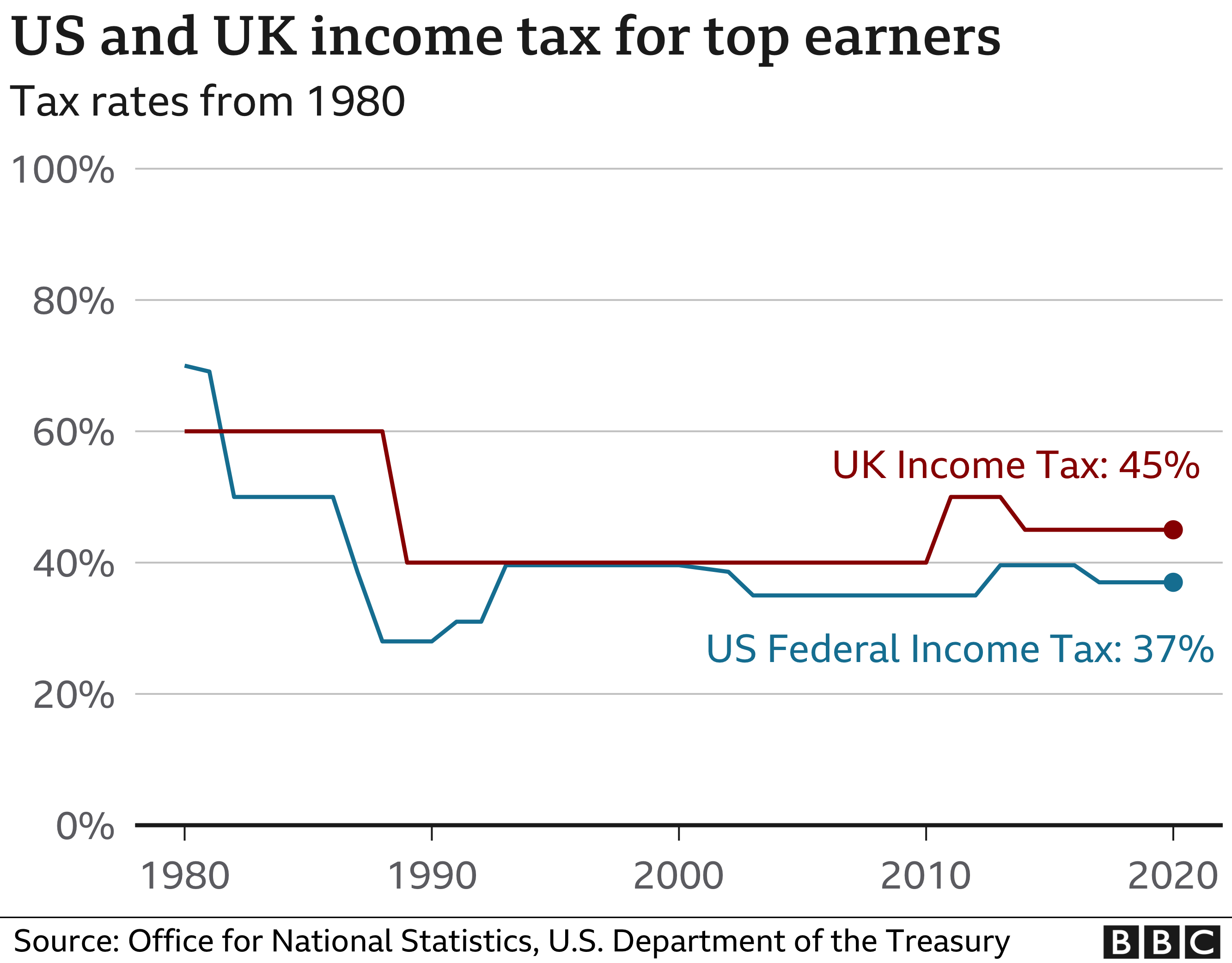

The top individual tax rate dropped from 396 to 37 and numerous itemized deductions were eliminated or affected as well. Still some taxpayers make out.

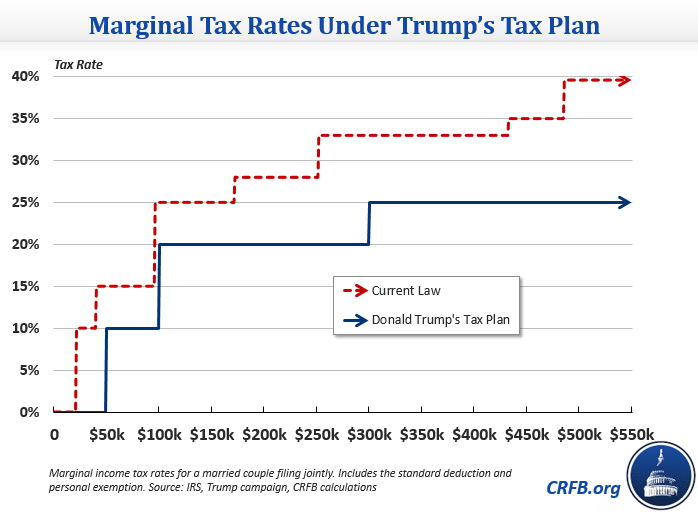

Donald Trump Releases Huge Tax Plan Committee For A Responsible Federal Budget

Donald Trump Releases Huge Tax Plan Committee For A Responsible Federal Budget

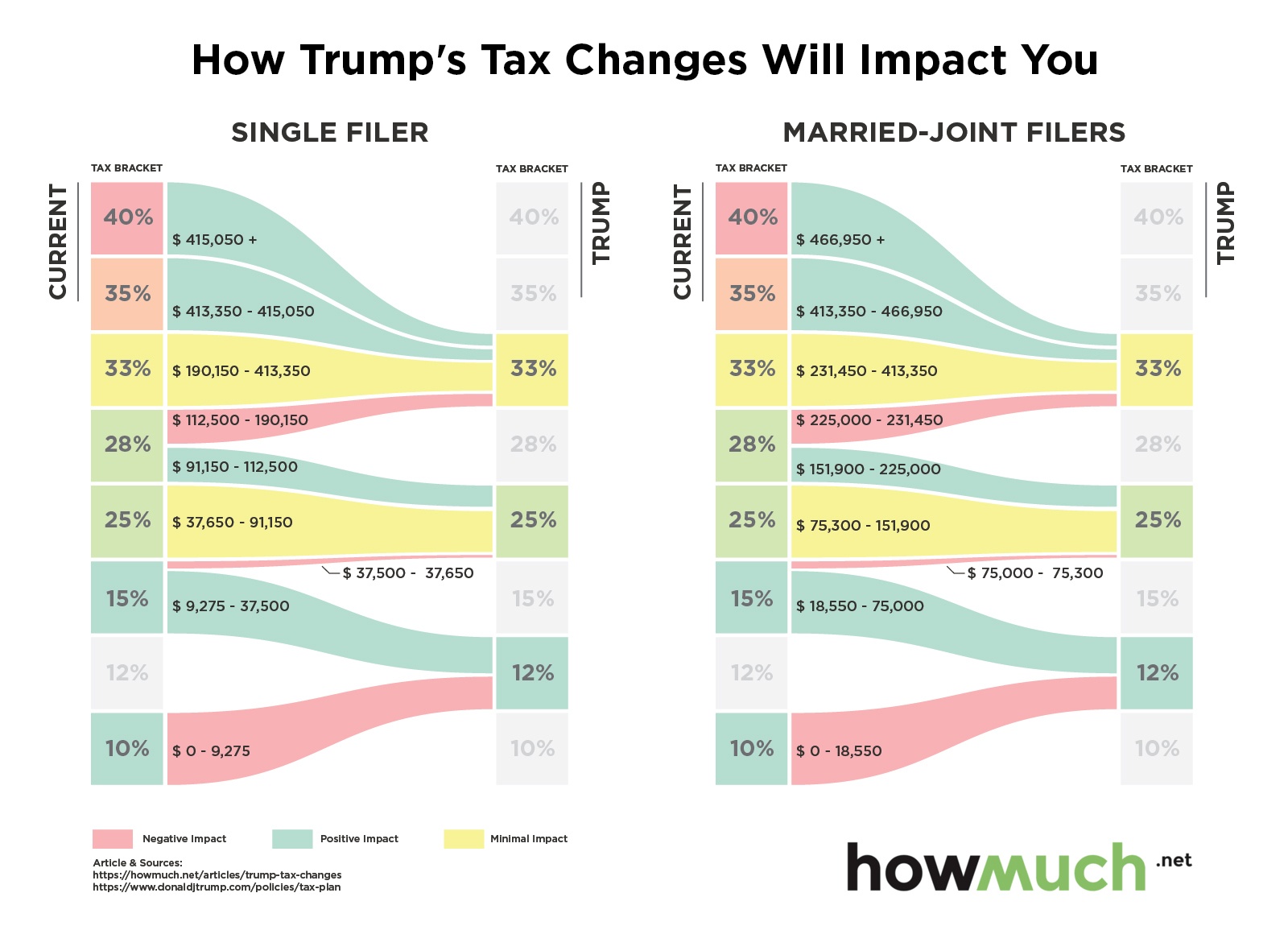

There are still seven federal income tax brackets but at slightly lower rates and adjusted income ranges.

Trump tax rates. But Trumps tax cuts his most significant legislative victory proved a tipping point. A fairer benchmark is what would happen to taxes while the Trump cuts are still in place. In his Indiana speech of 2018 Trump said that cutting the top corporate tax rate from 35 to 20 the rate proposed at the time will cause jobs to start pouring into our country as companies.

A married couple whose total income minus deductions is 250000 for instance would have had a tax rate of up to 33 in 2017. Biden also plans to tax foreign profits of American corporations at 21 while Trumps bill placed this rate at 105. For 2018 2019 and beyond their highest tax rate is just 24.

That was not just lower than the official top income tax rate of 47 but lower than the rate charged on someone earning just 15000. In 2025 according to the Tax Policy Center the top 1 would get 25 of the cut. Trump originally had a 55 trillion framework in mind for his tax cut that would have been among the.

Trumps tax cut passed under TCJA is a 15 trillion tax cut over the course of a decade. The biggest changes under the new Trump tax plan came for those in the middle of the chart. Trump and his advisers a year ago floated the idea of a 15 income tax rate for middle-income Americans down from the current 22 for individuals making up to 85000 a year.

Deductions are used on a persons tax return to lower the income they have to pay federal income tax on. President Donald Trump signed the Tax Cuts and Jobs Act TCJA on Dec. In January 2018 Trump imposed tariffs on solar panels and washing machines of 30 to 50 percent.

Under the new Trump tax brackets he wont be in the new top rate of 37 unless his taxable income is more than 500000. That led to a fairly significant difference in take-home pay. As a result of this Fred Trump Jrs estate only had to pay 700000 in estate taxes.

Two years ago President Donald Trump and Republicans in Congress cut the corporate tax rate from 35 percent to 21 percent via the Tax Cuts and Jobs Act of. Thats still a lot but. So here are the results of the Trump.

Donald Trumps tax returns reveal why he really ran for president Analysis by Chris Cillizza CNN Editor-at-large Updated 1011 AM ET Mon September 28 2020. In March 2018 he imposed tariffs on steel 25 and aluminum 10 from most countries which according to Morgan Stanley covered an estimated 41 percent of US. In 1960 the 400 richest families paid as much as 56 in taxes by 1980 the rate had fallen to 40.

If they had declared these properties on their estate tax return at their full value they would have had to pay nearly 60 million according to estate tax rates and exclusions in that year. The Tax Cuts and Jobs Act of 2017 TCJA is a congressional revenue act of the United States signed into law by President Donald Trump which amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for businesses and individuals increasing the standard deduction and family tax credits eliminating personal exemptions and making it less beneficial to. Those taxpayers accounted for 4 percent of total income roughly the same as in 2017 but their share of taxes was one percent slightly less than in 2017.

It cut individual income tax rates doubled the standard deduction and eliminated personal exemptions from the tax code. On June 1 2018 this was extended to the European Union Canada and Mexico.

The Two Biggest Lies In Donald Trump S Tax Plan The American Prospect

The Two Biggest Lies In Donald Trump S Tax Plan The American Prospect

Tax Planning For Trump The Next Four Years

Tax Planning For Trump The Next Four Years

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Trump Wants Tax Plan To Cut Corporate Rate To 15 Wsj

Trump Wants Tax Plan To Cut Corporate Rate To 15 Wsj

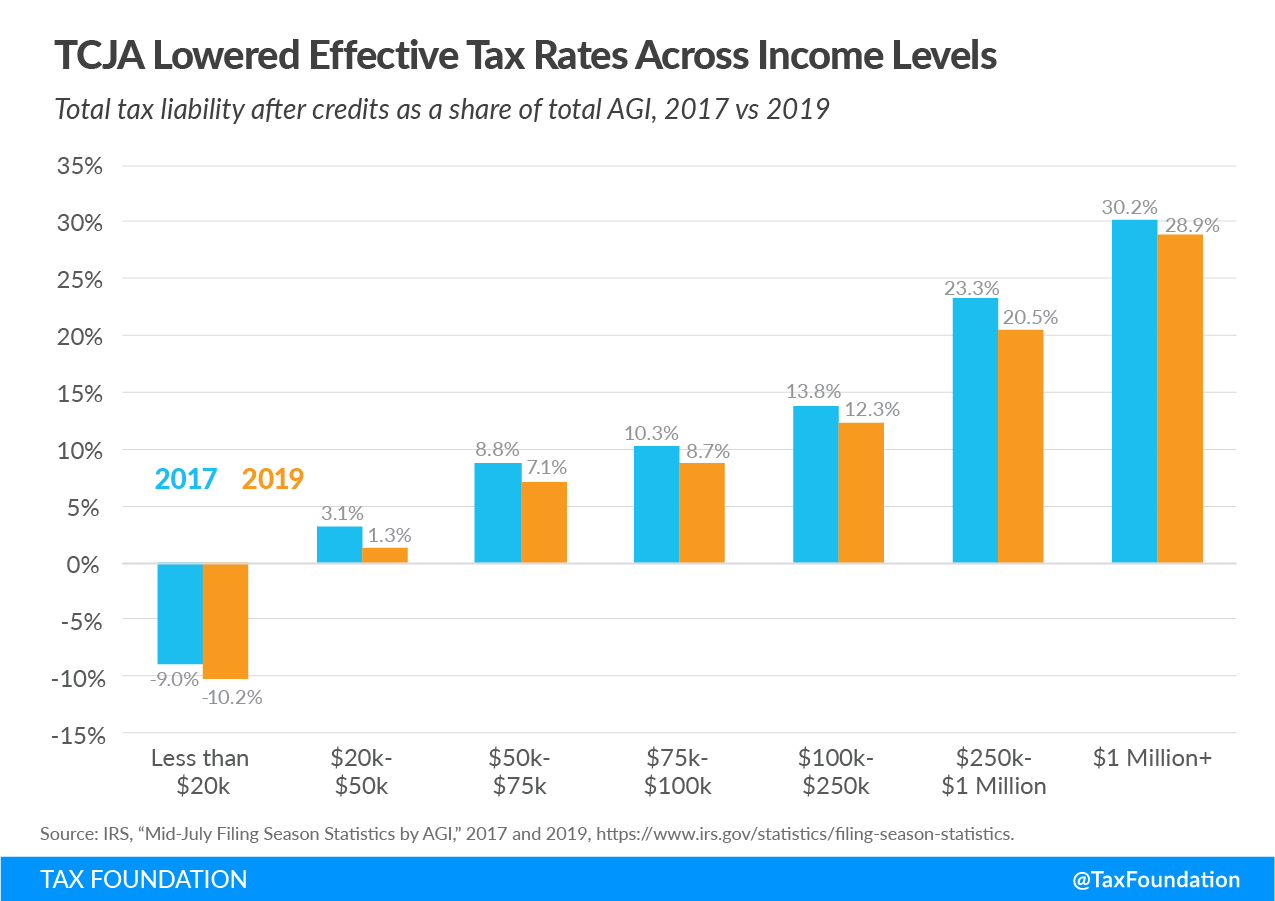

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Trump And Clinton S Tax Rates Tax Policy Center

Trump And Clinton S Tax Rates Tax Policy Center

These Companies Could Lose The Most From Trump S Tax Plan

These Companies Could Lose The Most From Trump S Tax Plan

Trump And Biden Tax Policies Cato At Liberty Blog

Trump And Biden Tax Policies Cato At Liberty Blog

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Tax Brackets 2018 How Trump S Tax Plan Will Affect You

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Tax Brackets 2018 How Trump S Tax Plan Will Affect You

Trump Taxes A Fundamentally Unfair System Bbc News

Trump Taxes A Fundamentally Unfair System Bbc News

Comments

Post a Comment