Wealth Tax Pros And Cons

It can cause productive capital to leave and discourage foreign investors from entering a country at least this was the factor for which Ireland and the Netherlands did away with wealth tax. Ad Debt Consolidation Pros And Cons Search Now.

Pros And Cons Of A Wealth Tax Explained In 6 Research Backed Reasons The Thread

Pros And Cons Of A Wealth Tax Explained In 6 Research Backed Reasons The Thread

What Are the Advantages of a Wealth Tax.

Wealth tax pros and cons. This is one of the benefits of a wealth tax over an income taxit taxes those who already have wealth versus those who are currently trying to earn wealth. Wealth taxes allow policymakers to reach the assets of the wealthiest citizens more effectively both increasing government revenue and making the system fairer. A wealth tax unfairly punishes success of individuals who.

Before we get into the pros and cons of a wealth tax it must be said that this is another daily media example of how we promote the false notion that the federal government is responsible to the citizens. The Onion takes a look at the pros and cons of. Continue reading -The post Wealth Tax.

Over 85 Million Visitors. A wealth tax would help reduce wealth inequality which is at historically high levels. Democratic presidential candidates Bernie Sanders and Elizabeth Warren have proposed a wealth tax as a way to increase government funding and reduce income inequality but critics of such proposals argue they can cause more harm than benefits.

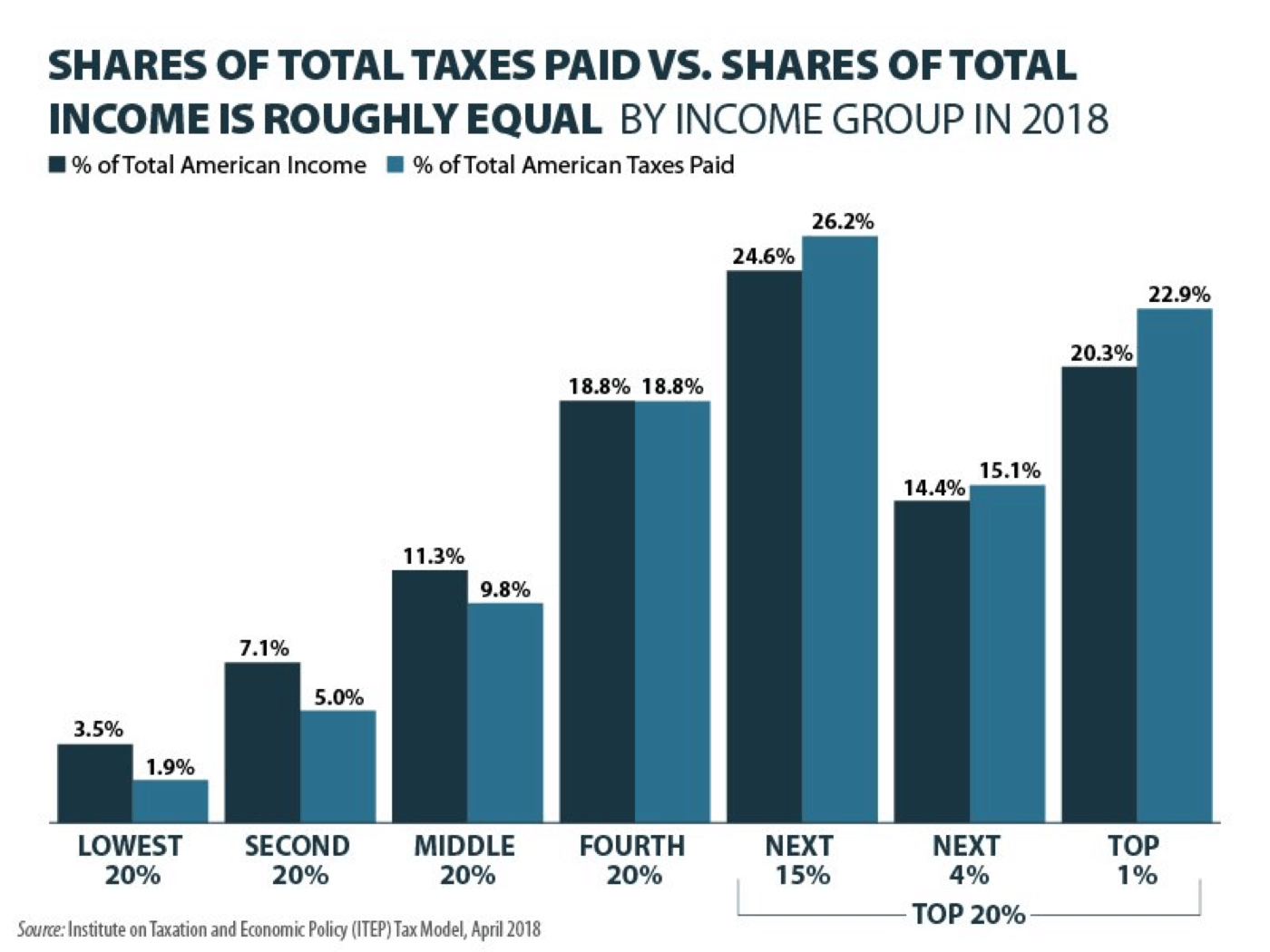

Definition Examples Pros and Cons appeared first on SmartAsset Blog. A group of nineteen billionaires and multi-millionaires. Wealth redistributionTaxes help in redistribution of wealth by allowing high-income earners pay more taxes compared to low-income earners.

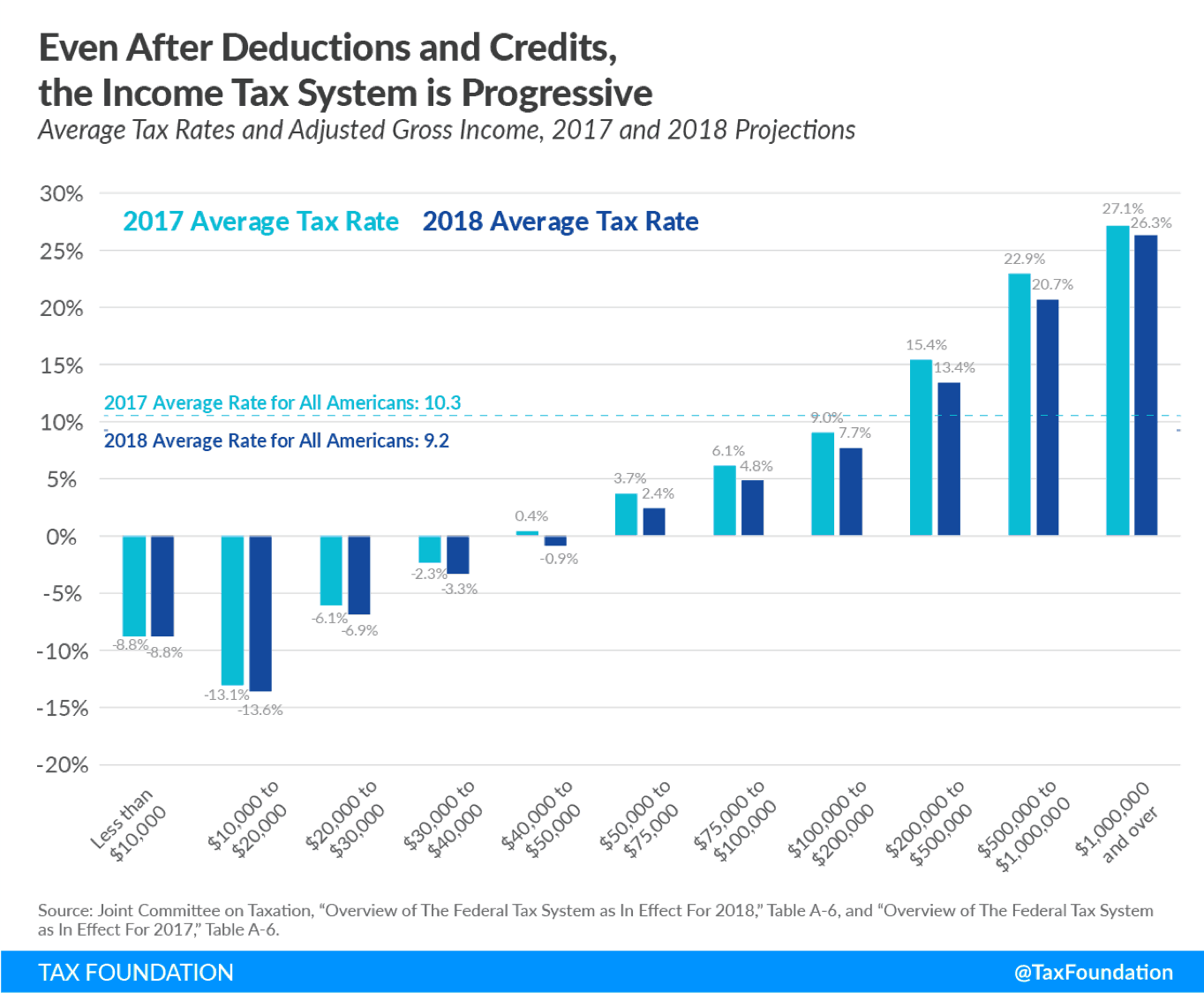

Help Rebalance Opportunity in the US. Pros Cons of a Wealth Tax. Typical income taxes are not an effective way to tax the ultra-wealthy as they earn most of their money via investments and other means.

In Hungary the eighteen years period passed since the change of political regime has seen the formation of a socio-economic pattern in which there are practically no middle class and middle sized enterprises both a mainstay for Western countries society. The wealth tax rates are typically lower than income tax rates in terms of the actual percentage rate but that doesnt necessarily mean paying less in taxes. Roughly 80 of millionaires in the US.

Pros and Cons Economic Studies journal Bulgarian Academy of Sciences - Economic Research Institute issue 1 pages 5-14Handle. Someone who has substantial assets that are subject to a wealth tax for instance may end up paying more toward that tax than income tax if theyre able to reduce their taxable income by claiming tax breaks. We love to quote poll numbers or refer to polls to show the.

Reduce Pools of Stagnant Wealth. The main points of criticism about wealth tax are as follows. As you can see a wealth tax would raise a lot of money in theory and would raise it from those individuals that have seen the largest wealth gains in the last half century.

PROS OF A WEALTH CREDIT. A wealth tax is a type of tax thats imposed on the net wealth of an individual. Earned their wealth instead of inheriting it.

Ad Debt Consolidation Pros And Cons Search Now. The different elements of the tax base on which the tax is raised are very unevenly. Pros Cons The US Presidential Elections are coming up in 2020 and several candidates from the Democratic Party have vowed to implement a wealth tax if elected.

- it is not neutral enough ie. US Government and States leaders are delving into the topic themselves and leaders on all spectrums of the political and. Like any fiscal policy there are advantages and disadvantages of implementing a wealth tax.

The wealth tax has its pros and cons but does one outway the other. Another reasons isSome self-made and inherited billionaires have called for a wealth tax. By The Hammer March 3 2021.

Pros And Cons Of A Wealth Tax. Puts a wealth tax in place there are a few potentially appealing aspects especially for middle-class Americans. Source of government revenueTaxes is a source of government funding and allows the government to spend the money on improving the countrys infrastructure.

- it may contribute to capital outflow ie. In the Hungarian society there are the wealthy and. A wealth tax punishes success and will hurt the economy by discouraging business investments.

One of the most popular talking points of those promoting some form of a wealth tax is that it would help to partially balance the scales. For example Elizabeth Warren the US Senator for Massachusetts has included in her campaign a 2-to-3 percent annual wealth tax on individuals with an amassed wealth of more than 50 million. Over 85 Million Visitors.

If a wealth tax actually does what its proponents believe it will here are a few of its most appealing features.

Wealth Tax Explained What Is It Will It Happen

Wealth Tax Explained What Is It Will It Happen

Wealth Tax Pros And Cons Study Finds That Taxing Sa S Rich Could Raise Over R100 Billion Youtube

Wealth Tax Pros And Cons Study Finds That Taxing Sa S Rich Could Raise Over R100 Billion Youtube

The Wealth Tax Pros Cons Taxlinked Net

The Wealth Tax Pros Cons Taxlinked Net

Pdf Wealth Tax Pros And Cons Miklos Somai Academia Edu

Pdf Wealth Tax Pros And Cons Miklos Somai Academia Edu

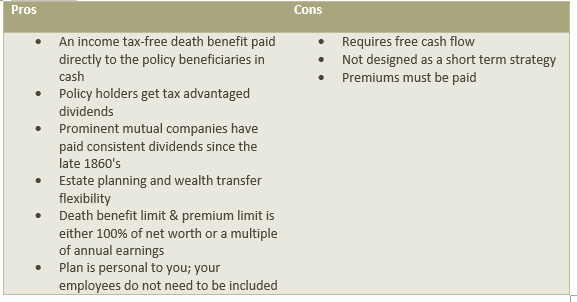

The Pros And Cons Of Life Insurance As An Investment Alternative For Estate Planning

The Pros And Cons Of Life Insurance As An Investment Alternative For Estate Planning

Wealth Tax In India Wealth Tax Act 1957 Investify In

Wealth Tax In India Wealth Tax Act 1957 Investify In

Wealth Tax What It Is Pros Cons Of Current Proposals

Wealth Tax What It Is Pros Cons Of Current Proposals

29 Crucial Pros Cons Of Taxes E C

29 Crucial Pros Cons Of Taxes E C

Are Wealth Taxes A Good Idea Of Dollars And Data

Are Wealth Taxes A Good Idea Of Dollars And Data

Wealth Tax In India Wealth Tax Act 1957 Investify In

Wealth Tax In India Wealth Tax Act 1957 Investify In

The Wealth Tax Pros Cons Taxlinked Net

The Wealth Tax Pros Cons Taxlinked Net

Are Wealth Taxes A Good Idea Of Dollars And Data

Are Wealth Taxes A Good Idea Of Dollars And Data

The Pros And Cons If Inheritance Tax Makes A Comeback In Budget 2019 Business Standard News

The Pros And Cons If Inheritance Tax Makes A Comeback In Budget 2019 Business Standard News

Comments

Post a Comment