How Much Taxes Do You Pay On Slot Machine Winnings

Under IRS rules you must report winnings from any type of gambling activityincluding lotteries racing bingo sports slot machines and cardsno matter how much you. For practical purposes it does not make sense to report winnings every time you win 50 cents in a slot machine.

News Blog Casino Tips Tricks San Diego Ca Golden Acorn Casino And Travel Centerhow Are Casino Winnings Taxed Golden Acorn Casino

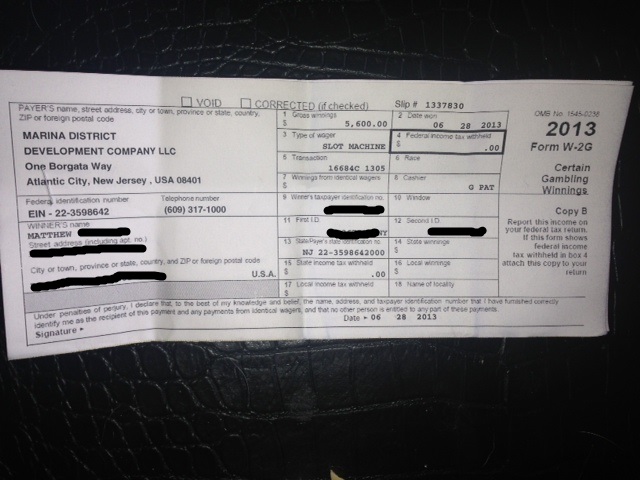

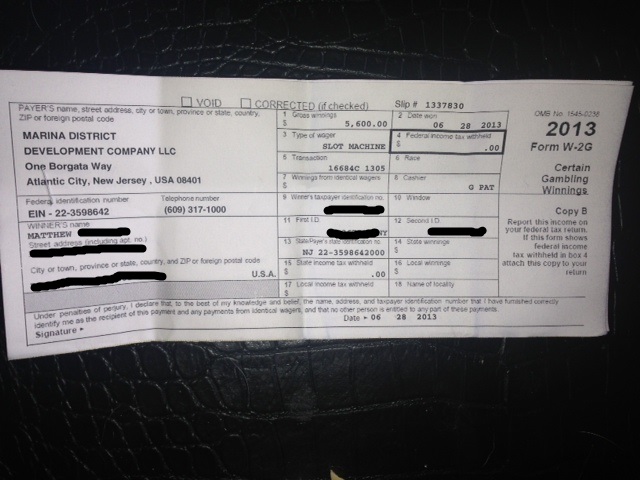

When you have a win equal to or greater than 1200 you are issued a W-2G form.

How much taxes do you pay on slot machine winnings. In some cases the tax 25 is already deducted by the casino before you are paid your winning. The answer actually varies depending on what you play. If you hit a single jackpot of 1200 or more you will have to fill out a W-2G tax form and since you are not from the US they will withhold 30.

Casinos will issue W-2Gs for winnings greater than 1200 from a slot machine or 5000 from poker. Many players will tip somewhere between a half to one percent of the jackpot. All casino winnings are subject to federal taxes.

However the IRS only requires the casinos to report wins over 1200 on slots and video poker machines or other games such as keno lottery or horse racing. When you do receive a hand paid jackpot they never bring you bills smaller than a twenty. Basically if you win 1200 or more from a bingo game or slot machine 1500 or more from a keno game 5000 from a poker tournament or 600 or.

Whether you win 1500 at the slot machine or 1 million at the poker table the tax rate you owe on your gambling winnings is 24 previously 25. If the FMV exceeds 5000 after deducting the price of the wager the winnings are subject to 24 regular gambling withholding. Withholding is required when the winnings minus the bet are.

Give the cage your name and Social Security number and your tax bill will be settled before you leave the property. The winner pays the withholding tax to the payer. You can file a claim to get the withheld money back.

Withholding is effected if your winnings minus your wager are above 5000 or at least 300 times your wager. In most cases the casino will take 25 percent off your winnings for IRS gambling taxes before paying you. Instead the federal government has set a 25 percent tax rate on minimum.

Not all gambling winnings in the amounts above are subject to IRS Form W2-G. Casual gamblers are only able to deduct wagers up to the amount of their winnings. The tax you must withhold is computed and paid under either of the following two methods.

For a thousand dollar jackpot this would be between 5 to 10 dollars. That lack of oversight extends to wins up to 5000. W2-G forms are not required for winnings from table games such as blackjack craps baccarat and roulette regardless of the amount.

However at that point the casino itself is bound to collect 25 on the governments behalf before it releases your winnings to you. If youve ever won a jackpot in Las Vegas you probably know that your excitement diminishes at least a little when the casino throws a W-2G tax form in your face. More than 5000 from sweepstakes wagering pools lotteries.

If you didnt give the payer your tax ID number the withholding rate is also 24. This means gamblers who won 500 in a year but spent 2000 in. However if you fail to give your tax ID number to the payer 28 of the winnings will be withheld instead of the usual 25.

If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24. There are firms that specialize in getting you your refund for a cut of the money. In fact if you dont provide your social security number the casino will automatically withhold up to 30 of your winnings.

/close-up-of-illuminated-slot-machine-918722780-5ae76e4dc5542e0039090e66.jpg) Do You Have To Pay Taxes On A Slot Machine Jackpot

Do You Have To Pay Taxes On A Slot Machine Jackpot

Taxes On Slot Machine Winnings Explained 2021 Askgamblers

Taxes On Slot Machine Winnings Explained 2021 Askgamblers

Aga Wants Trump Administration To Revise Tax Threshold On Slots

Aga Wants Trump Administration To Revise Tax Threshold On Slots

Need To Pay Taxes On Slot Machine Winnings Hitcasinobonus Com

Need To Pay Taxes On Slot Machine Winnings Hitcasinobonus Com

7 Biggest Slot Machine Wins Of All Time Blog The Island Now

7 Biggest Slot Machine Wins Of All Time Blog The Island Now

Slot Machine Winnings Your Taxes Explained Jackpotfinder

Slot Machine Winnings Your Taxes Explained Jackpotfinder

Do You Have To Pay Income Tax On Gambling Winnings Reviewing Logs For Slot Machines Play Profits And Deducting Financial Loss

Do You Have To Pay Income Tax On Gambling Winnings Reviewing Logs For Slot Machines Play Profits And Deducting Financial Loss

When You Handpay What Happens With Taxes Know Your Slots

When You Handpay What Happens With Taxes Know Your Slots

Taxes On Slot Machine Winnings Explained 2021 Askgamblers

Taxes On Slot Machine Winnings Explained 2021 Askgamblers

Do You Have To Pay Taxes On Slot Machine Winnings My Blog

Do You Have To Pay Taxes On Slot Machine Winnings My Blog

4 Different Taxes For Various Gambling Games Bk Info Inc

What If You Win A 60 000 Slot Machine Jackpot Hand Pay Professor Slots

What If You Win A 60 000 Slot Machine Jackpot Hand Pay Professor Slots

The Rules For Offsetting Casino Winnings For Tax Purposes For Non Professional Gamblers Saverocity Finance

The Rules For Offsetting Casino Winnings For Tax Purposes For Non Professional Gamblers Saverocity Finance

Comments

Post a Comment