Roth Ira Or Stocks

Traditional 401k The Roth IRA and 401k are closely related in terms of the benefits they provide. Coba strategi Anda dengan perdagangan kecil mulai dari 1.

Diversify Further Checkbook Investing With Ira Funds Seeking Alpha

Diversify Further Checkbook Investing With Ira Funds Seeking Alpha

And after your account has been open at least five.

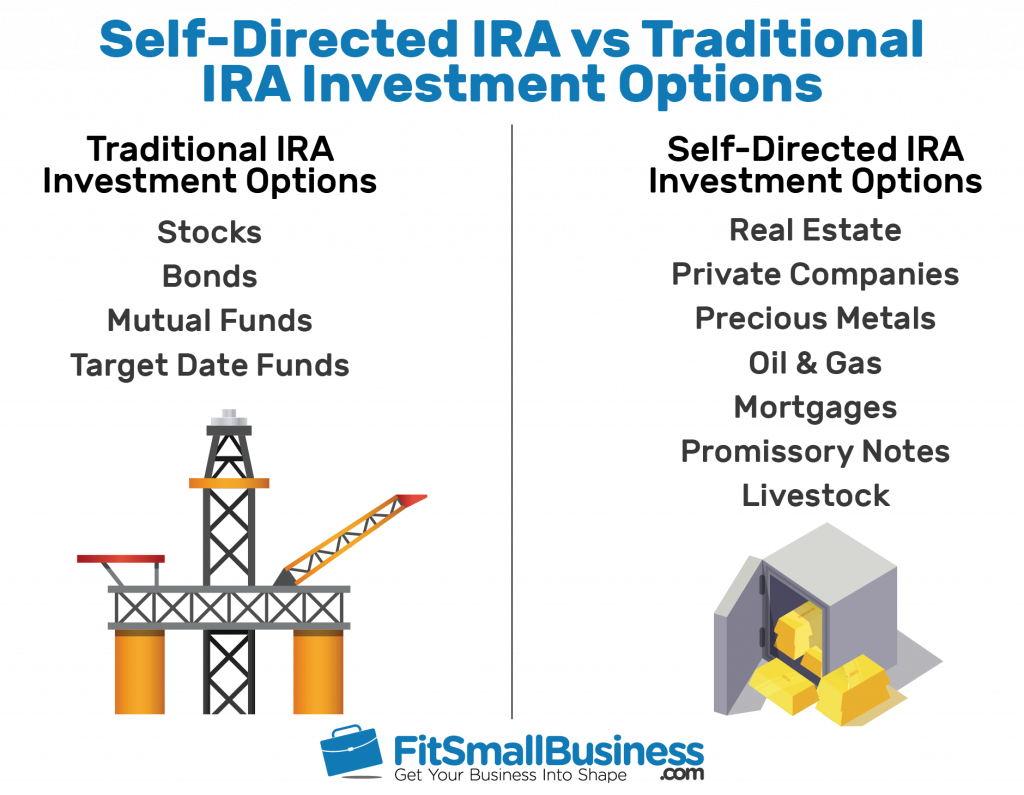

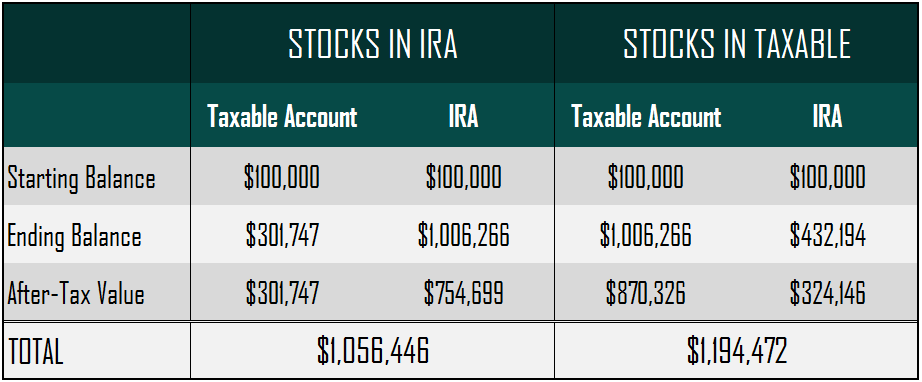

Roth ira or stocks. Pengaturan trading yang fleksibel. The argument is that if you hold stocks in Traditional IRA and the stock market does well youll have large RMDs which is undesirable. Roth IRA USA vs Stocks and Shares ISA UK The UKs stocks and shares Individual Savings Account ISA is the equivalent of the USAs Roth IRA.

As mentioned earlier in most cases it makes sense to use both. Trading with your Roth IRA is a lot like the way you would trade using traditional stocks. Ad Buat prediksi dan lihat hasilnya dalam 1 menit.

Roth IRA-worthy investments with the fewest tax advantages include taxable bonds real estate investment trust REITs and trusts that hold physical commodities. In this case however you are trading with funds in your retirement account. You must make regular contributions to your Roth individual retirement account IRA by cash or check.

Contributing securities is not allowed. The main difference as I mentioned earlier is that your returns are tax free so you can reinvest all your profits. These penny stocks do not make for proper long term investments in most cases.

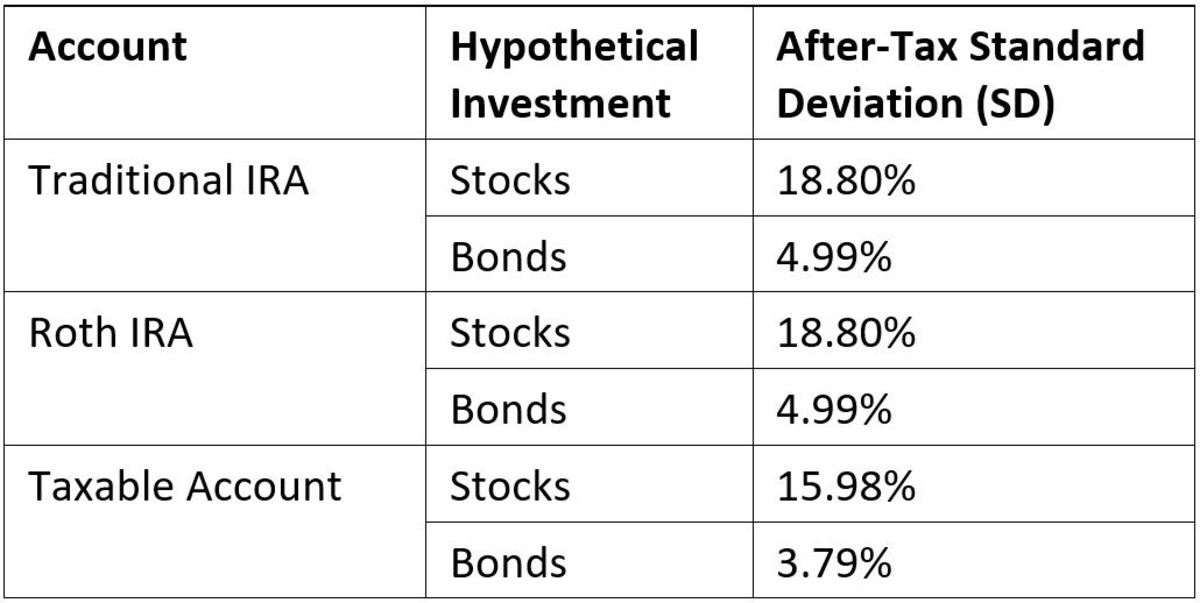

Given the tax characteristics of the two types of IRAs its generally better to hold investments with the greatest growth potential typically stocks in a Roth while assets with more. Bonus sambutan untuk pemula. Ad Buat prediksi dan lihat hasilnya dalam 1 menit.

Also most stocks are well-regarded dividend payers with solid track records and a history of steady or increased payouts over time. The ISA was offered by the UK government to its population as an incentive for them to increase their savings and build wealth throughout the nation. Whats The Difference.

The Best Stocks for Roth IRAs Individual stocks are another asset type commonly held by Roth IRA accounts. Neither do you pay taxes on withdrawals nor on the earnings generated by stocks if you wait until you turn 59½. The Roth IRA is a special type of IRA but a lot of the same rules apply so we can general your question to not be Roth specific.

With more risk comes the potential for a great return. Investing your Roth IRA in stocks allows you to buy them and sell them for capital gains and enjoy dividend income without paying taxes. Coba strategi Anda dengan perdagangan kecil mulai dari 1.

All of these investments are taxed. Realizing or selling large gains from a position that has experienced tremendous growth can lead to. Thats because in general an IRA allows investments in all kinds of financial vehicles.

Importantly this portfolio is all within a Rollover IRA which was transferred from my wifes company 401k plan after she retired. A Roth IRA is an excellent vehicle to hold onto stocks. Can I buy stocks with my IRA.

The short answer is still technically yes. This may boost overall yield in future years. What you wont find in a Roth IRA are penny stocks that dont trade on major exchanges.

Bonus sambutan untuk pemula. What is Roth IRA Trading. In fact Roth IRA investors are more exposed to equities than their traditional IRA.

The Risks of Owning Stocks in Your Roth IRA Adviser Patrick Kuster of Buckingham Strategic Wealth explains how you can tilt the overall amount of risk. For example if you have a Roth IRA with 50000 of contributions and losses have brought the value down to 40000 you could close all your Roth IRAs and claim a 10000 loss subject to the 2. The one exception is via a rollover if the same.

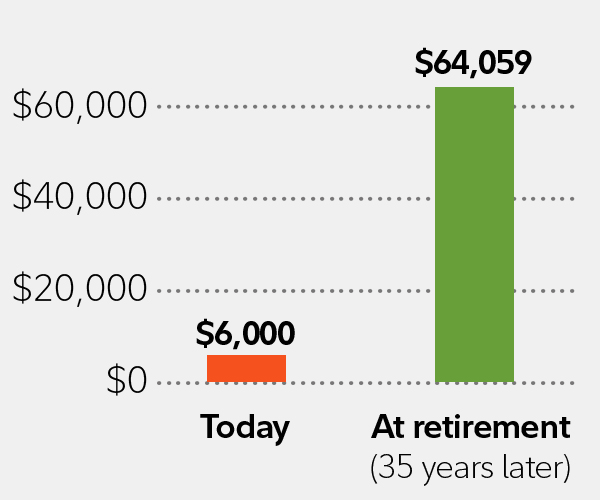

One of the beauties of the Roth Guay says is that you can withdraw any money youve put into the IRA at any time without taxes or penalties. Stocks are among the riskier asset classes. Why stocks in a Roth IRA are smart The key attribute of a Roth IRA is that any gains on the assets within the account are tax free even when you withdraw them in retirement.

Stocks in Roth Reduce Your Required Minimum Distributions RMDs This is the only stocks-in-Roth argument that survives a little scrutiny but it cant stand a lot of scrutiny. Pengaturan trading yang fleksibel.

Infographic How To Invest In A Roth Ira Investing Finances Money Finance Investing

Infographic How To Invest In A Roth Ira Investing Finances Money Finance Investing

The Layers Of Investing Why Ira Vs Index Funds Doesn T Make Sense Personal Finance Club

The Layers Of Investing Why Ira Vs Index Funds Doesn T Make Sense Personal Finance Club

Roth Ira Contribution Rules How To Start One Nerdwallet

Roth Ira Contribution Rules How To Start One Nerdwallet

The Risks Of Owning Stock In Your Roth Ira Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

The Risks Of Owning Stock In Your Roth Ira Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

So You Ve Got A Roth Ira Now How Should You Invest It Seeking Alpha

So You Ve Got A Roth Ira Now How Should You Invest It Seeking Alpha

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

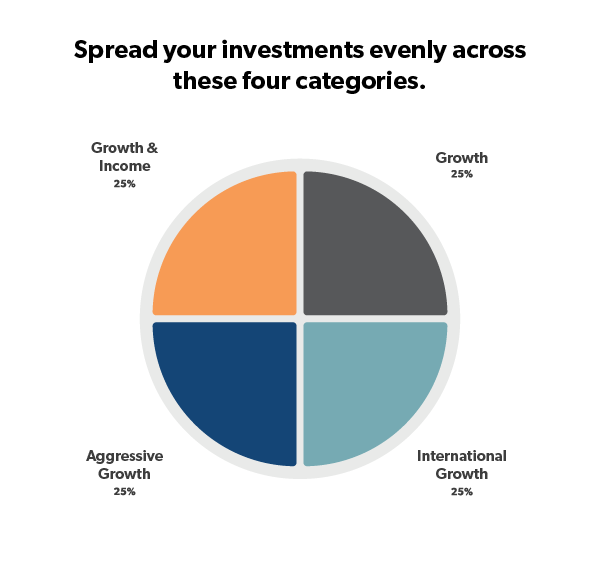

How To Start A Roth Ira Ramseysolutions Com

How To Start A Roth Ira Ramseysolutions Com

Roth Ira Vs Stocks Shares Isa What S The Difference Pain Free Investing

Roth Ira Vs Stocks Shares Isa What S The Difference Pain Free Investing

How To Invest Your Ira Fidelity

How To Invest Your Ira Fidelity

Dividend Investing In A Roth Ira

Roth Iras How To Optimize Yours For 2021

Roth Iras How To Optimize Yours For 2021

The 1 Stock You Ve Been Overlooking For Your Roth Ira The Motley Fool

The 1 Stock You Ve Been Overlooking For Your Roth Ira The Motley Fool

Roth Ira Custer Financial Advisors

Roth Ira Custer Financial Advisors

Comments

Post a Comment