Federally Backed Mortgage

Mortgages that are backed by the federal government are funded through government-sponsored entities or GSEs. The Federal Housing Administration FHA the US.

Understanding What A Federally Backed Mortgage Loan Means Integrity First Lending

Understanding What A Federally Backed Mortgage Loan Means Integrity First Lending

Federally backed mortgages include FHA VA USDA Fannie Mae and Freddie Mac.

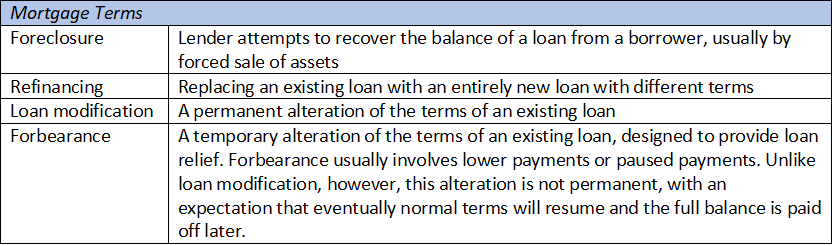

Federally backed mortgage. This includes most mortgages. A government-backed mortgage is a loan insured by one of three federal government agencies. Homeowners with federally backed loans have the right to ask for and receive a forbearance period for up to 180 dayswhich means you can pause or reduce your mortgage payments for up to six months.

Or you can define some mortgage payment a little bit above your average mortgage payment to make up the difference Silvia told us while this program only applies to federally-backed. Nerdwallet has put together a guide to verifying your mortgage type. Each federally backed mortgage program has issued guidance on how servicers should proceed.

What if your loan is not federally backed. Deadlines for Federally Backed Mortgage Foreclosures. The policies allowed people.

Anyone that has a loan that is backed by Fannie Mae Freddie Mac VA FHA or USDA are all federally backed mortgages. Around 27 million homeowners are enrolled in COVID-19 forbearance plans. 1 How to Request a Forbearance Extension.

Federally backed mortgages do account for about 70 but what if you fall into the 30 of mortgages that are not federally backed by Fannie Freddie FHA VA USDA. Generally borrowers have the option to make the missed payments in a lump sum through a repayment plan that adds a portion of the missed payments to the regular monthly payment or. For loans backed by HUDFHA USDA or VA you can request an initial forbearance through June 30 2021.

This includes conventional loans backed by Fannie Mae and Freddie Mac FHA loans VA loans and USDA loans. The CARES Act provides for affected borrowers to defer their mortgage payments for up to 180 days. There are 11 million federal government-backed mortgages nationwide.

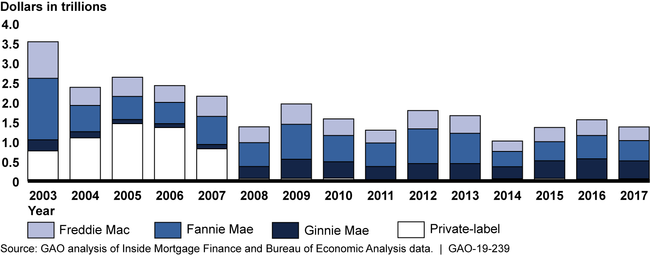

About 50 of all mortgage loans in the US. Federally-backed mortgages generally include HUD USDA FHA VA Freddie Mac and Fannie Mae loans. Contact them at 800-443-1032 to apply for payment relief.

Although the federal agencies believe continued assistance is needed for their borrowers we note that the number of borrowers taking advantage of their. That includes any mortgage that is or has been owned guaranteed or secured by one of several federal agencies or government-sponsored enterprises GSEs such as the Federal National Mortgage. 800 am - 1000 pm Monday - Thursday 800 am - 800 pm Friday 900 am - 300 pm Saturday ET.

Programs are available for mortgage relief including a minimum of a 90 day-forbearance. Fannie Mae and Freddie Mac do not currently have a deadline for requesting an initial forbearance. Are backed by a GSE which makes them by far the most popular choice for millions of homeowners.

Fannie Mae Homeready program Freddie Mac. Department of Agriculture USDA or the Department of Veterans Affairs VA. Federally-backed multi-family mortgages can also be eligible for up to two additional 30-day forbearance periods.

Additionally you can request an extension of forbearance for up to 180 additional days for a total of 360 days. Borrowers with federally backed mortgage loans continue to have the right to request forbearance of up to a years payments under the Coronavirus Relief and Economic Security Act CARES Act from their mortgage servicer. Also remember that the CARES Act provides this benefit to homeowners with federally backed mortgages.

Also lenders of federally backed mortgages were prohibited from launching foreclosures for a 60-day period beginning March 18. There are five different types of federally-backed mortgages. The first is a temporary suspension called a moratorium of foreclosures and it runs through June 30 2021 for mortgages backed by Fannie Mae Freddie Mac the Department of Housing and Urban Development HUD FHA mortgages Department of Agriculture USDA mortgages and Department of Veterans Affairs VA mortgages.

So you will need to know what type of mortgage you have. If you are not sure if your mortgage is Federal-backed call your loan servicer to find out. To be eligible for mortgage relief under the CARES Act your loan must have been federally owned or backed by one of these federal agencies or entities.

In March 2020 the federal government rolled out a series of measures to protect homeowners during the COVID-19 pandemic.

Mortgages Backed By Federal Government Eligible For Deferred Payments Through Cares Act Due To Covid Abc7 Chicago

Mortgages Backed By Federal Government Eligible For Deferred Payments Through Cares Act Due To Covid Abc7 Chicago

My Mortgage Is Not Federally Backed Will The Cares Act Help Find My Way Home

My Mortgage Is Not Federally Backed Will The Cares Act Help Find My Way Home

Housing Provisions In The Coronavirus Aid Relief And Economic Security Cares Act Aaf

Housing Provisions In The Coronavirus Aid Relief And Economic Security Cares Act Aaf

Federally Backed Mortgage Foreclosure Moratoria Extended Through 2020

Federally Backed Mortgage Foreclosure Moratoria Extended Through 2020

![]() Fha Mortgage Concept Icon Stock Vector Illustration Of Insured 199133506

Fha Mortgage Concept Icon Stock Vector Illustration Of Insured 199133506

U S Restricts Raising Cap On Federally Backed Mortgages Wsj

U S Restricts Raising Cap On Federally Backed Mortgages Wsj

Relief For Homeowners And Renters Impacted By Covid 19 Enterprise Community Partners

Relief For Homeowners And Renters Impacted By Covid 19 Enterprise Community Partners

![]() Fha Mortgage Concept Icon Federal Housing Administration Type Idea Thin Line Illustration Low Loan Balance Federally Backed Mortgages Vector Isolated Outline Rgb Color Drawing Editable Stroke Stock Images Page Everypixel

Fha Mortgage Concept Icon Federal Housing Administration Type Idea Thin Line Illustration Low Loan Balance Federally Backed Mortgages Vector Isolated Outline Rgb Color Drawing Editable Stroke Stock Images Page Everypixel

Federally Backed Mortgage Payments Can Be Paused 3 Million Already Have Al Com

Federally Backed Mortgage Payments Can Be Paused 3 Million Already Have Al Com

What Are Your Coronavirus Mortgage Relief Options Lexington Law

What Are Your Coronavirus Mortgage Relief Options Lexington Law

Housing Finance Prolonged Conservatorships Of Fannie Mae And Freddie Mac Prompt Need For Reform

Housing Finance Prolonged Conservatorships Of Fannie Mae And Freddie Mac Prompt Need For Reform

Eviction And Foreclosure Moratorium On Federally Backed Mortgages Extended Through January Forbes Advisor

Eviction And Foreclosure Moratorium On Federally Backed Mortgages Extended Through January Forbes Advisor

Comments

Post a Comment