How Much Do You Make On Social Security

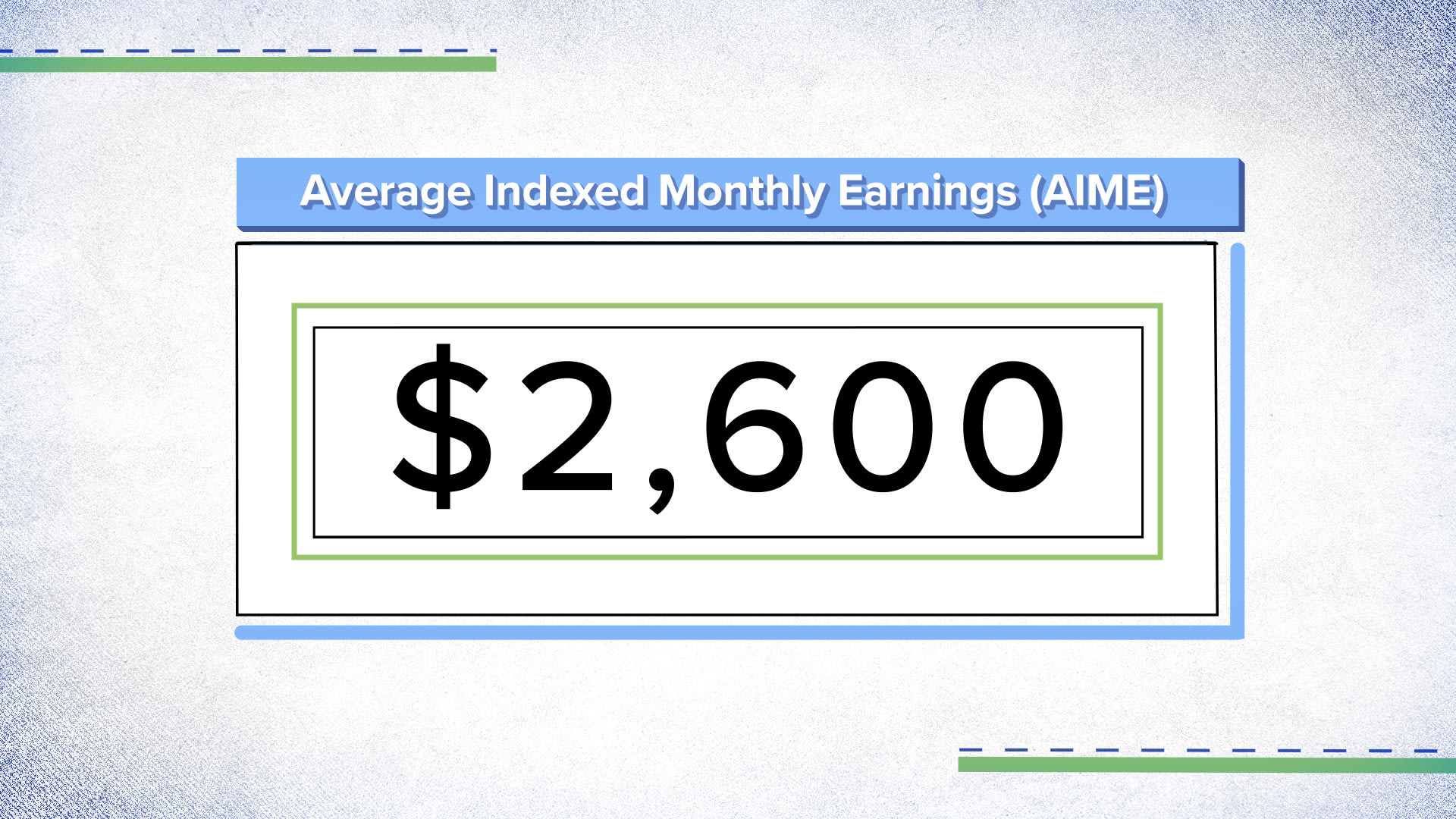

The annual payment you receive from Social Security is based on your income birth year and the age at which you elect to begin receiving benefits. The Social Security Administration SSA will take your 35 highest-earning years into consideration.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

If your combined income is between 25000 and 34000 as an individual filer or between 32000 and 44000 as joint filers you would pay tax on up to 50 of your Social Security benefits.

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png)

How much do you make on social security. If you collect Social Security benefits during the year you reach FRA Social Security will deduct 1 in benefits for every 3 you earn over the limit. When Your FRA Is. The maximum possible Social Security benefit for someone who retires at.

Dummies has always stood for taking on complex concepts and making them easy to understand. Plus your employer matches the 62 percent payment for a total of 124 percent of your wages. If you plan to work in retirement and also collect Social Security benefits some of your benefits may be temporarily withheld based on your income.

During the year you reach FRA Social Security only counts earnings that you receive before the month you reach FRA. So if you are a high-income earner and earned 60000 in the first half of the year then reach FRA and begin your Social Security. Dummies helps everyone be more knowledgeable and confident in applying what they know.

If you earn more than this amount you can. The IRS calculates combined income by adding nontaxable interest and half of your Social Security benefits to your adjusted gross income. 1200 x 20 24000.

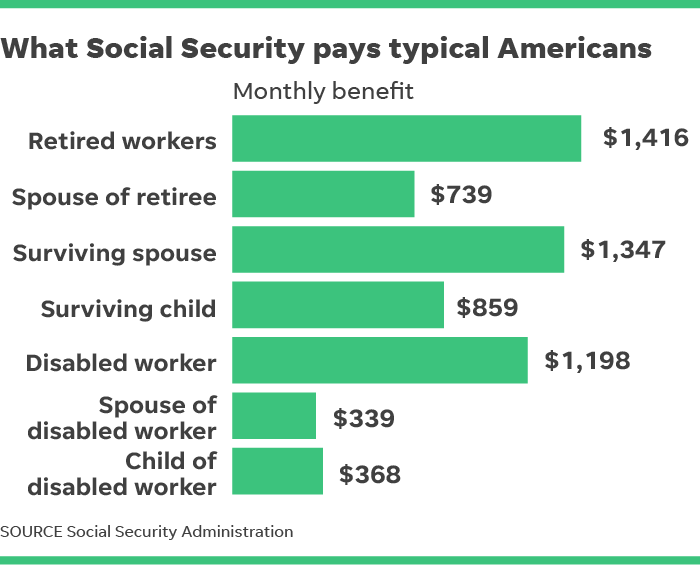

Your Benefits Will Be. We Americans earn our benefits by working for many years and paying the Social Security tax in each of those years. For tax year 2020 this point is.

Full Retirement and Age 62 Benefit By Year Of Birth Before You Make Your Decision. That tax is 62 percent of your wages up to a ceiling 127200 in 2017. But suppose you earned that 30000 from January to September 2021 then started Social Security in October.

The Social Security earnings limit is 1470 per month or 17640 per year in 2019 for someone age 65 or younger. Until you reach full retirement age your. However you may notice that this is not the final amount of your paycheck.

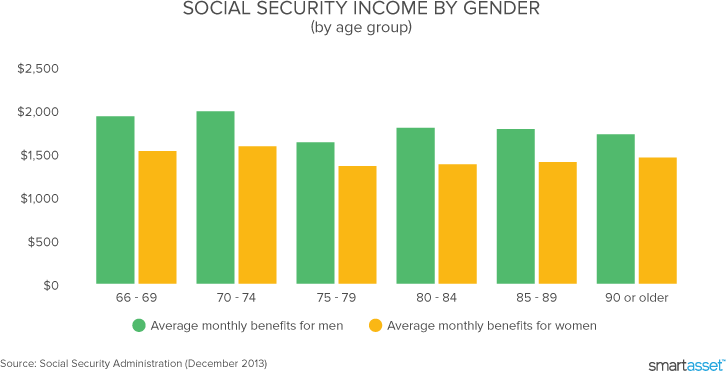

You will receive 40982 in annual social security payments starting at age 66. The average Social Security benefit was 1543 per month in January 2021. My social security election age.

As long as you have earned income such as wages youre required to pay Social Security taxes on up to the annual payroll limitation137700 in 2020. Those gains range from 65 percent claiming at 70 rather than 69 to 84 percent. Because of how the wage indexing formula works if you are not yet 62 your calculation to determine how much Social Security you will get is only an estimate.

If You Claim Social Security at This Age Instead of 62. However you could attribute an assumed inflation rate to average wages to estimate. Instead of Increase Increase.

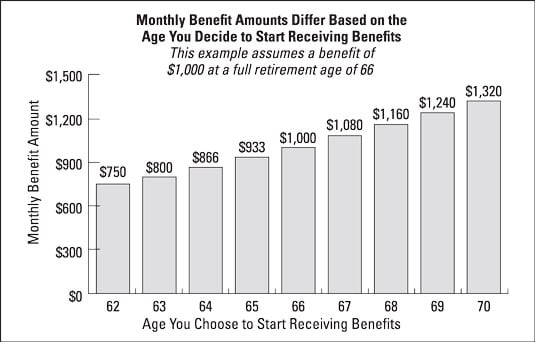

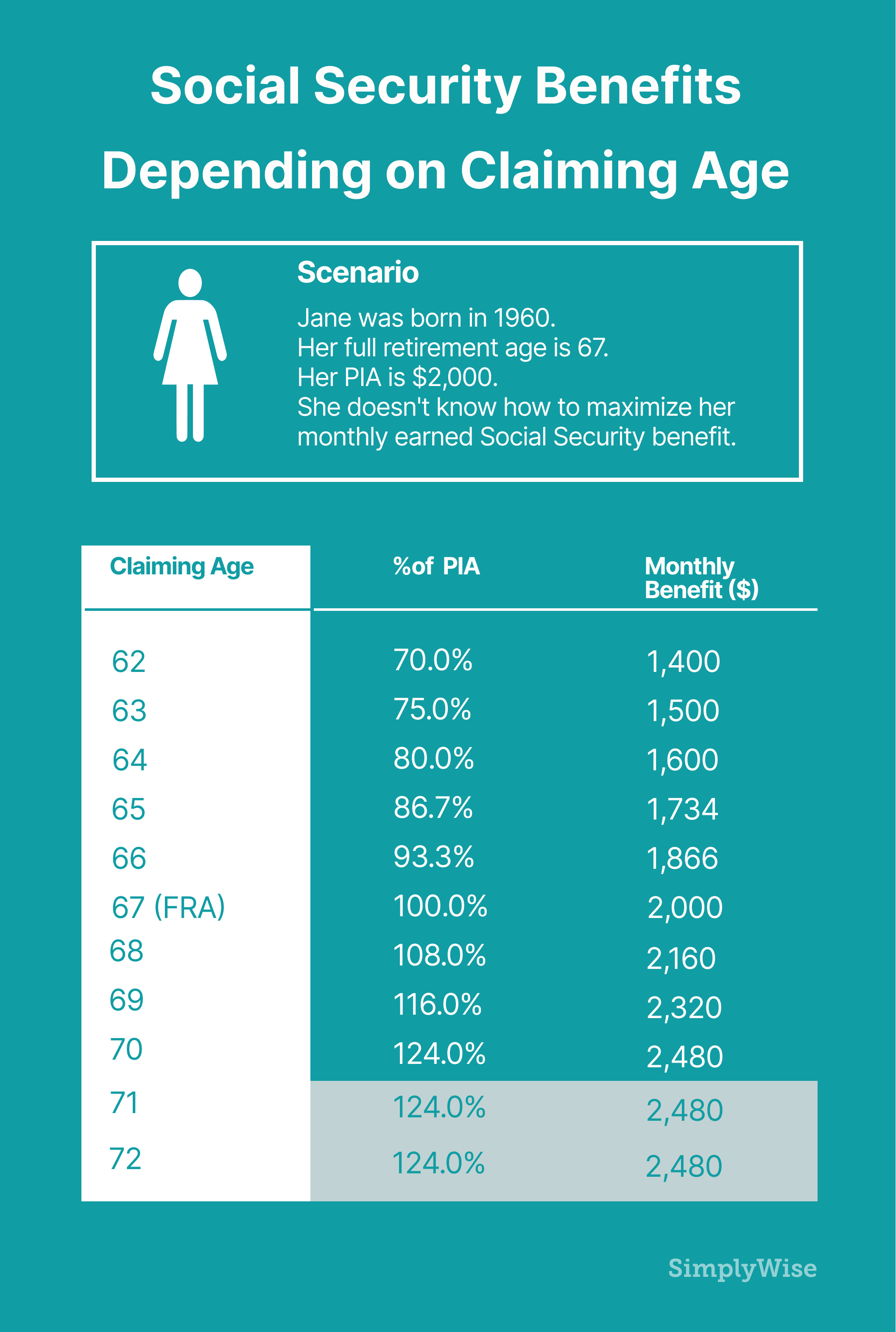

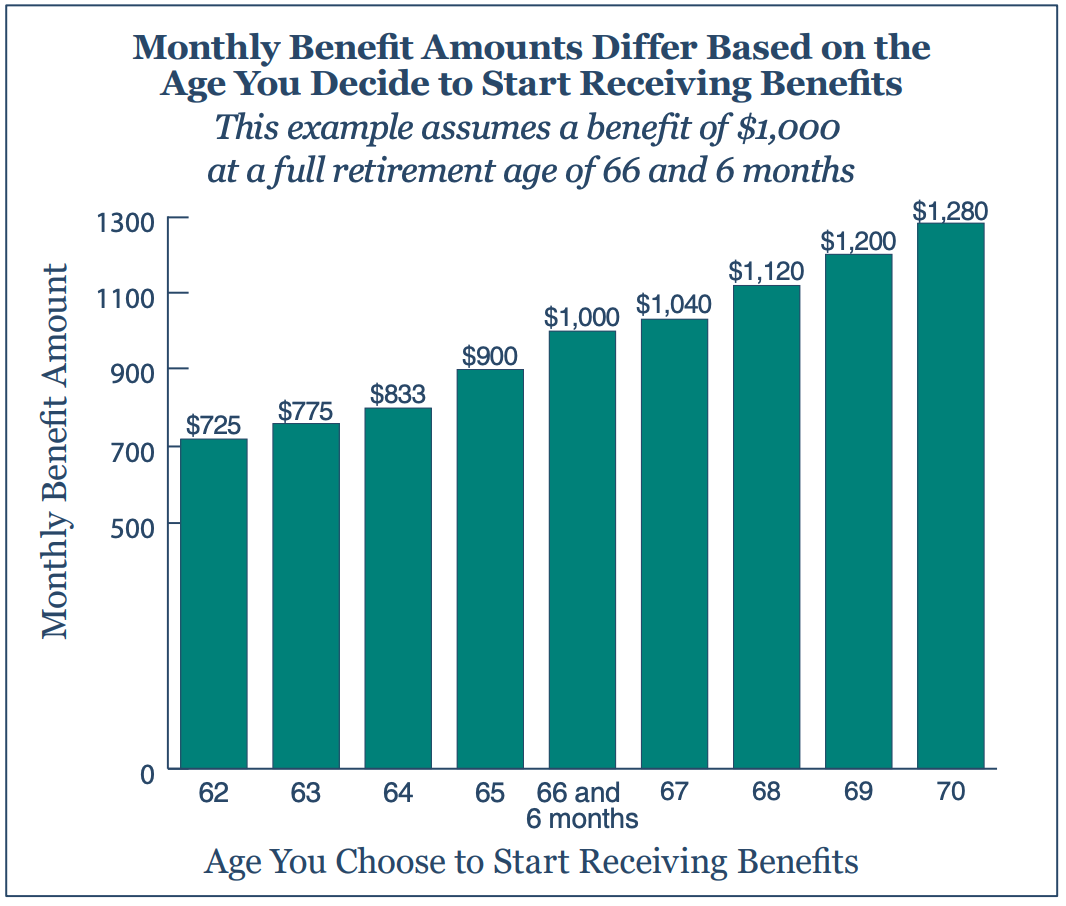

This example is based on an estimated monthly benefit of 1000 at full retirement age. That means that your gross pay for that pay period is 240. To find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age use the chart below and select your year of birth.

For each of those years it will index your income for inflation and include it up to the taxable maximum the point at which you stop paying Social Security taxes. So yes if you continue to work youll continue to pay into Social Security and other payroll taxes. The actual year-over-year percentage gain for ages 62 to 70 are shown in the following table.

The maximum Social Security retirement benefit you can collect in 2020 is 3790 per month but very few people will receive that big of a payday. For instance if your pay period is one week and you worked 20 hours at 1200 per hour. If you are on Social Security for the whole year and make 30000 from work you are 11040 over the limit and lose 5520 in benefits.

Until you know the average wages for the year you turn 60 there is no way to do an exact calculation.

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

2021 The Year Social Security Changes Forever Social Security Intelligence

2021 The Year Social Security Changes Forever Social Security Intelligence

How To Estimate How Much Social Security You Ll Get Each Month Dummies

How To Estimate How Much Social Security You Ll Get Each Month Dummies

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

How Much Does Social Security Pay On Average To Retired Workers

How Much Does Social Security Pay On Average To Retired Workers

What Happens If You Work While Receiving Social Security Social Security Us News

What Happens If You Work While Receiving Social Security Social Security Us News

Full Retirement Age For Getting Social Security The Motley Fool

Full Retirement Age For Getting Social Security The Motley Fool

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

Social Security Calculator How Much Your Benefits Will Be In 2021

Social Security Calculator How Much Your Benefits Will Be In 2021

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Study Only 1 In 300 Seniors Know These 5 Social Security Rules Simplywise

Study Only 1 In 300 Seniors Know These 5 Social Security Rules Simplywise

Https Www Post Journal Com Life 2017 04 Social Security And What You Can Expect

How Much Can You Make While Receiving Social Security

How Much Can You Make While Receiving Social Security

Comments

Post a Comment